Lenovo 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011/12 Annual Report Lenovo Group Limited 115

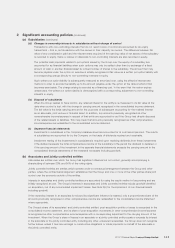

2 Significant accounting policies (continued)

(d) Translation of foreign currencies (continued)

(iv) On the disposal of a foreign operation (that is, a disposal of the Group’s entire interest in a foreign operation, or a

disposal involving loss of control over a subsidiary or loss of significant influence over an associate that includes a

foreign operation), all of the exchange differences accumulated in equity in respect of that operation attributable to

the equity holders of the Company are reclassified to the consolidated income statement.

In the case of a partial disposal that does not result in the Group losing control over a subsidiary that includes a

foreign operation, the proportionate share of accumulated exchange differences are reclassified to non-controlling

interests. For partial disposals in the Group’s ownership interest in an associate, the proportionate share of the

accumulated exchange differences is reclassified to the consolidated income statement.

(e) Property, plant and equipment

Property, plant and equipment are stated at historical cost less accumulated depreciation and accumulated impairment

losses.

Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only

when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item

can be measured reliably. The carrying amount of the replaced part is derecognized. All other repairs and maintenance

are charged in the income statement during the financial period in which they are incurred.

Freehold land and buildings comprise mainly factories and office premises. All freehold lands are located outside Hong

Kong and are not depreciated. Depreciation of buildings, buildings related equipment and leasehold improvements is

calculated using the straight-line method to allocate their costs to their estimated residual values over the unexpired

periods of the leases or their expected useful lives to the Group ranging from 10 to 50 years whichever is shorter.

Depreciation on other property, plant and equipment is calculated using the straight-line method to allocate their costs

to their estimated residual values over their estimated useful lives to the Group. The principal annual rates used for this

purpose are:

Plant and machinery

Tooling equipment 50%

Other machinery 14 – 20%

Furniture and fixtures 20 – 25%

Office equipment 20 – 33%

Motor vehicles 20%

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date. An

asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater

than its estimated recoverable amount (Note 2(h)).

Gain or loss on disposal of property, plant and equipment is the difference between the net sales proceeds and the

carrying amount of the relevant asset, and is recognized within other operating income/(expense) – net in the income

statement.

(f) Construction-in-progress

Construction-in-progress represents building, plant and machinery and internal use software under construction and

pending installation and is stated at historical cost, less any accumulated impairment losses. Historical cost comprises

all direct and indirect costs of acquisition or construction or installation of buildings, plant and machinery or internal use

software as well as interest expenses and exchange differences on the related funds borrowed during the construction,

installation and testing periods and prior to the date when the assets were available for use. No depreciation or

amortization is provided for on construction-in-progress. On completion, the buildings, plant and machinery or internal

use software are transferred to property, plant and equipment or intangible assets at historical cost less accumulated

impairment losses.