Lenovo 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 101

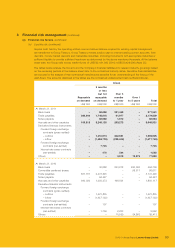

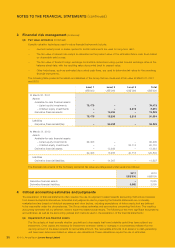

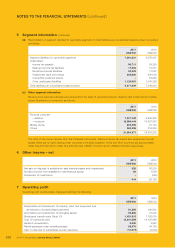

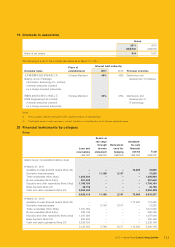

8 Finance income and costs

(a) Finance income

2011 2010

US$’000 US$’000

Interest on bank deposits 23,229 18,947

Interest on money market funds 1,118 950

Others 580 480

24,927 20,377

(b) Finance costs

2011 2010

US$’000 US$’000

Interest on bank loans and overdrafts 16,330 30,413

Dividend and relevant finance costs

on convertible preferred shares (Note 28(b)) 3,810 10,915

Factoring cost 17,022 10,600

Others 12,013 10,953

49,175 62,881

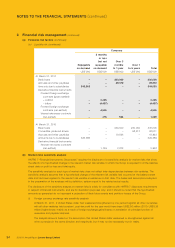

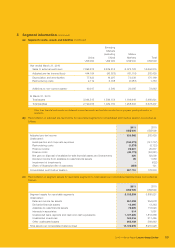

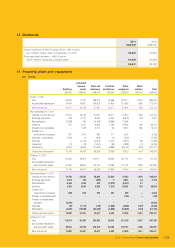

9 Taxation

The amount of taxation in the consolidated income statement represents:

2011 2010

US$’000 US$’000

Current tax

– Hong Kong profits tax 234 58

– Taxation outside Hong Kong 67,334 87,716

Deferred tax (Note 21) 16,947 (40,839)

84,515 46,935

Hong Kong profits tax has been provided at the rate of 16.5% (2010: 16.5%) on the estimated assessable profit for the year.

Taxation outside Hong Kong represents income and irrecoverable withholding taxes of subsidiaries operating in the Chinese

Mainland and overseas, calculated at rates applicable in the respective jurisdictions.

The Group has been granted certain tax concessions by tax authorities in the Chinese Mainland and overseas whereby the

subsidiaries operating in the respective jurisdictions are entitled to preferential tax treatment.

The differences between the Group’s expected tax charge, calculated at the domestic rates applicable to the countries

concerned, and the Group’s tax charge for the year are as follows:

2011 2010

US$’000 US$’000

Profit before taxation 357,751 176,303

Tax calculated at domestic rates applicable in countries concerned 95,520 16,875

Income not subject to taxation (95,994) (252,688)

Expenses not deductible for taxation purposes 67,727 262,091

Utilization of previously unrecognized tax losses (2,483) (77)

Effect on opening deferred income tax assets due to change in tax rates 1,743 867

Deferred income tax assets not recognized 10,383 12,131

Under-provision in prior years 7,619 7,736

84,515 46,935

The weighted average applicable tax rate for the year was 27% (2010: 10%).