Lenovo 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 113

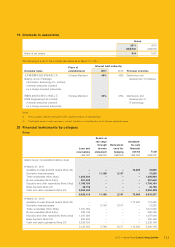

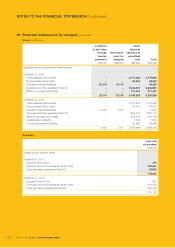

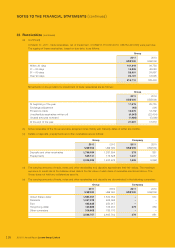

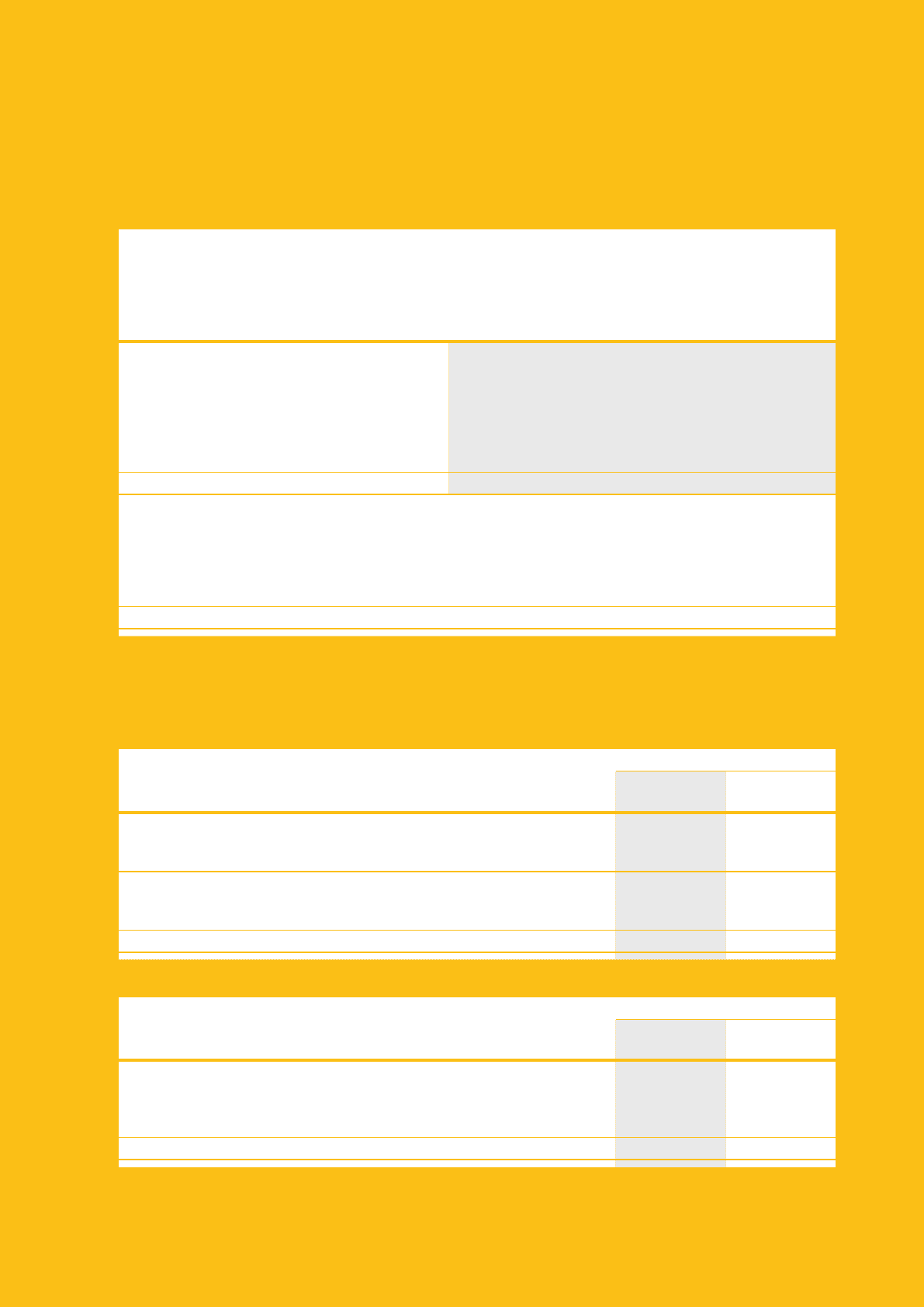

20 Financial instruments by category (continued)

Company (continued)

Liabilities

at fair value

through

income

statement

Derivatives

used for

hedging

Other

financial

liabilities at

amortized

cost Total

US$’000 US$’000 US$’000 US$’000

Liabilities as per balance sheet

At March 31, 2011

Derivative financial liabilities 4,547 1,018 –5,565

Accruals and other payables (Note 27) – – 39,319 39,319

Amounts due to subsidiaries (Note 18(b)) – – 549,503 549,503

Bank borrowings (Note 28(a)) – – 200,000 200,000

4,547 1,018 788,822 794,387

At March 31, 2010

Derivative financial liabilities 110 3,390 –3,500

Accruals and other payables (Note 27) – – 19,848 19,848

Amounts due to subsidiaries (Note 18(b)) – – 526,686 526,686

Bank borrowings (Note 28(a)) – – 430,000 430,000

Convertible preferred shares – – 94,980 94,980

110 3,390 1,071,514 1,075,014

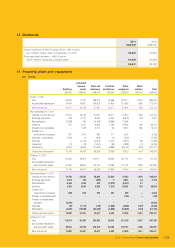

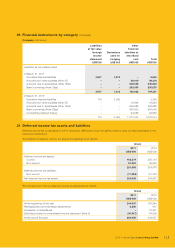

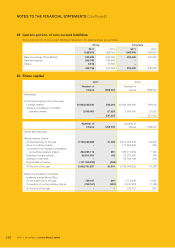

21 Deferred income tax assets and liabilities

Deferred income tax is calculated in full on temporary differences under the liability method using the rates applicable in the

respective jurisdictions.

The analysis of deferred income tax assets and liabilities is as follows:

Group

2011 2010

US$’000 US$’000

Deferred income tax assets:

Current 193,274 205,174

Non-current 57,824 49,804

251,098 254,978

Deferred income tax liabilities:

Non-current (17,093) (10,331)

Net deferred income tax assets 234,005 244,647

The movements in the net deferred income tax assets are as follows:

Group

2011 2010

US$’000 US$’000

At the beginning of the year 244,647 190,844

Reclassification and exchange adjustments 6,305 637

Acquisition of subsidiaries –12,327

(Debited)/credited to consolidated income statement (Note 9) (16,947) 40,839

At the end of the year 234,005 244,647