Lenovo 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

116

NOTES TO THE FINANCIAL STATEMENTS (continued)

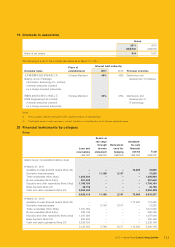

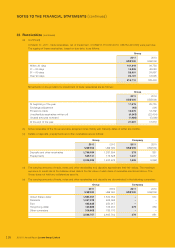

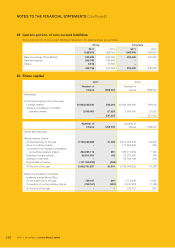

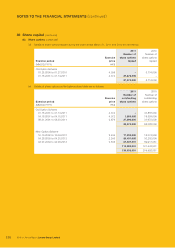

24 Receivables (continued)

(a) (continued)

At March 31, 2011, trade receivables, net of impairment, of US$213,710,000 (2010: US$182,403,000) were past due.

The ageing of these receivables, based on due date, is as follows:

Group

2011 2010

US$’000 US$’000

Within 30 days 141,819 94,758

31 – 60 days 16,809 48,083

61 – 90 days 28,901 24,967

Over 90 days 26,181 14,595

213,710 182,403

Movements on the provision for impairment of trade receivables are as follows:

Group

2011 2010

US$’000 US$’000

At beginning of the year 17,319 29,755

Exchange adjustment (45) 296

Provisions made 10,076 14,702

Uncollectible receivables written off (4,343) (22,434)

Unused amounts reversed (1,926) (5,000)

At the end of the year 21,081 17,319

(b) Notes receivable of the Group are bank accepted notes mainly with maturity dates of within six months.

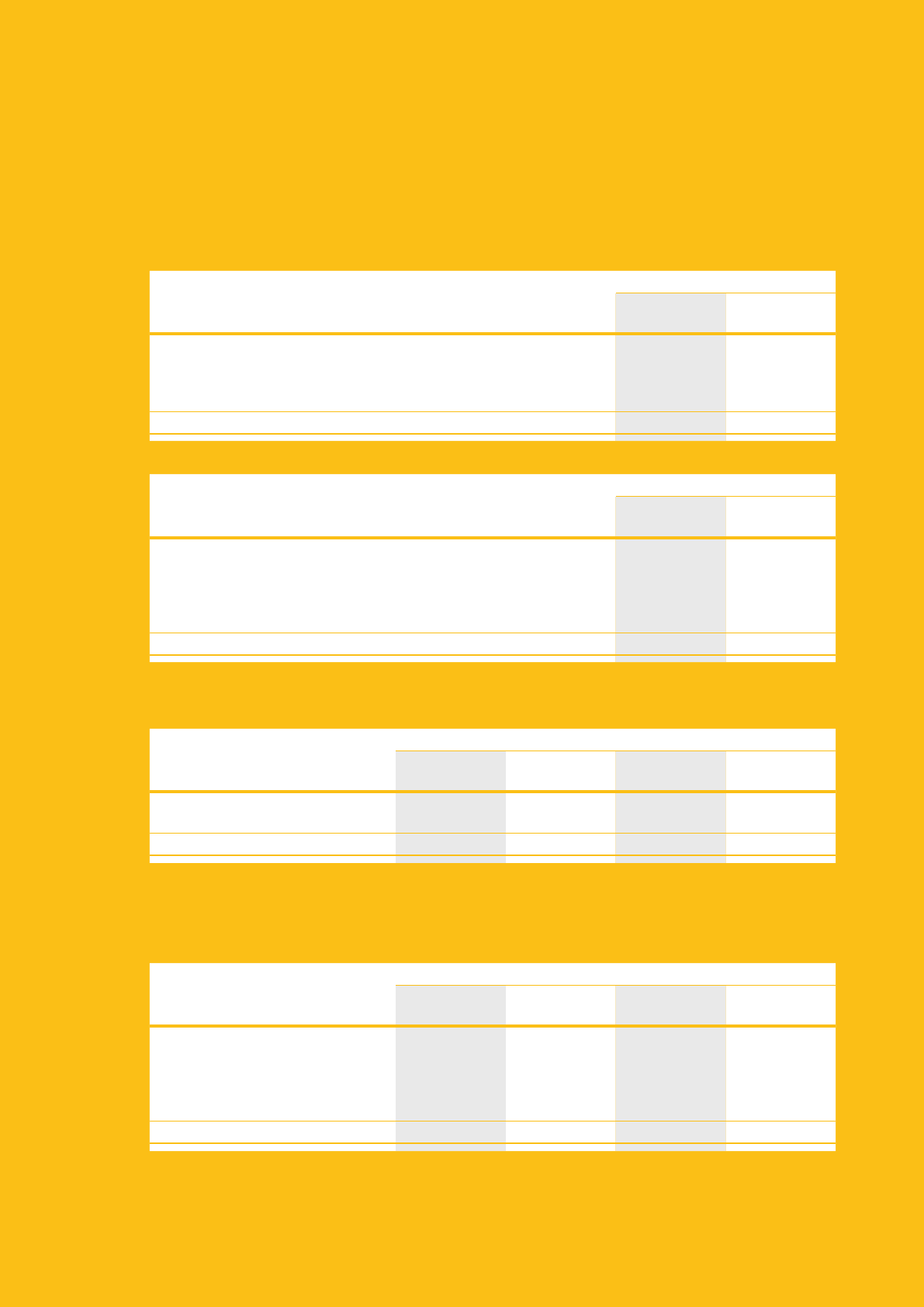

(c) Details of deposits, prepayments and other receivables are as follows:

Group Company

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Deposits and other receivables 1,766,184 1,287,894 379 881

Prepayments 539,141 175,528 1,247 5,017

2,305,325 1,463,422 1,626 5,898

(d) The carrying amounts of trade, notes and other receivables and deposits approximate their fair values. The maximum

exposure to credit risk at the balance sheet date is the fair value of each class of receivable mentioned above. The

Group does not hold any collateral as security.

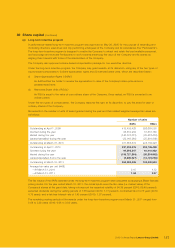

(e) The carrying amounts of trade, notes and other receivables and deposits are denominated in the following currencies:

Group Company

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

United States dollar 1,593,051 1,532,052 –531

Renminbi 1,057,078 625,006 ––

Euro 425,835 250,017 ––

Hong Kong dollar 130,888 105,457 379 350

Other currencies 319,905 183,170 ––

3,526,757 2,695,702 379 881