Lenovo 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

80

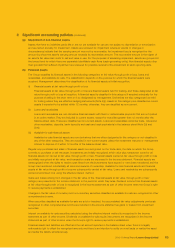

NOTES TO THE FINANCIAL STATEMENTS

1 Basis of preparation

The financial statements have been prepared in accordance with Hong Kong Financial Reporting Standards (“HKFRS”). The

financial statements have been prepared under the historical cost convention except that certain financial assets and financial

liabilities are stated at fair values, as explained in the significant accounting policies set out below.

The preparation of financial statements in conformity with HKFRS requires the use of certain critical accounting estimates.

It also requires management to exercise its judgment in the process of applying the Group’s accounting policies. The areas

involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the financial

statements are disclosed in Note 4.

The Group has adopted those revised standards, new interpretations, and amendments to existing standards and

interpretations (including certain amendments from improvements to HKFRS published in October 2008 and May 2009) that

are mandatory for the year ended March 31, 2011 and where considered appropriate and relevant to its operations.

HKFRS 3 (revised), “Business combinations” (effective for annual periods beginning on or after July 1, 2009) continues

to apply the acquisition method to business combinations with some significant changes. For example, all payments

to purchase a business are recorded at fair value at the acquisition date, with contingent payments classified as debt

subsequently re-measured through income statement. There is a choice on an acquisition-by-acquisition basis to measure

the non-controlling interest in the acquiree either at fair value or at the non-controlling interest’s proportionate share of the

acquiree’s net assets. When a business combination is achieved in stages, the acquirer should remeasure its previously held

interest in the acquiree at its fair value at the date control is obtained, recognizing a gain/loss in the income statement. All

acquisition-related costs should be expensed. The Group applies HKFRS 3 (revised) prospectively. The adoption of HKFRS

3 (revised) does not result in a material impact on the Group’s financial statements as there was no business combination

completed during the year ended March 31, 2011.

HKAS 27 (revised), “Consolidated and separate financial statements” (effective for annual periods beginning on or after July

1, 2009) requires the effects of all transactions with non-controlling interests to be recorded in equity if there is no change in

control and these transactions will no longer result in goodwill or gains and losses. The standard also specifies the accounting

requirements when control is lost. Any remaining interest in the entity is re-measured to fair value, and a gain or loss is

recognized in profit or loss. The amendment does not have a material impact on the Group’s financial statements.

The adoption of the other newly effective interpretations and amendments to existing standards and interpretations does not

result in substantial changes to the Group’s accounting policies or financial results.

At the date of approval of these financial statements, the following new and revised standards, new interpretation, and

amendments to existing standards and interpretations have been issued but are not effective for the year ended March 31,

2011 and have not been early adopted:

Effective for

annual periods

beginning on

or after

New and revised standards, new interpretation and amendments to

existing standard and interpretation

HKFRS 9, Financial instruments January 1, 2013

HKAS 24 (Revised), Related party disclosures January 1, 2011

HK(IFRIC)-Int 19, Extinguishing financial liabilities with equity instruments July 1, 2010

Amendments to HKFRS 7, Financial instruments: Disclosures – Transfers to financial assets July 1, 2011

Amendments to HKAS 12, Deferred tax: Recovery of underlying assets January 1, 2012

Amendments to HK(IFRIC)-Int 14, Prepayments of a minimum funding requirement January 1, 2011

Improvements to HKFRS 2010

Amendments to:

HKFRS 3 (Revised), Business combinations July 1, 2010

HKFRS 7, Financial instruments: Disclosures January 1, 2011

HKAS 1 (Revised), Presentation of financial statements January 1, 2011

HKAS 21, The effect of changes in foreign exchange rates July 1, 2010

HKAS 28, Investments in associates July 1, 2010

HKAS 31, Interests in joint ventures July 1, 2010

HKAS 32, Financial instruments: Presentation July 1, 2010

HKAS 34, Interim financial reporting January 1, 2011

HKAS 39, Financial instruments: Recognition and measurement July 1, 2010

HK(IFRIC)-Int 13, Customer loyalty programmes January 1, 2011