Lenovo 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

82

NOTES TO THE FINANCIAL STATEMENTS (continued)

2 Significant accounting policies (continued)

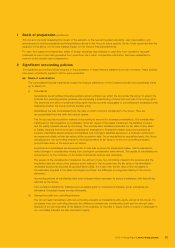

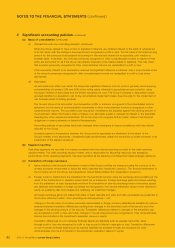

(a) Basis of consolidation (continued)

(ii) Transactions with non-controlling interests (continued)

When the Group ceases to have control or significant influence, any retained interest in the entity is remeasured

to its fair value, with the change in carrying amount recognized in profit or loss. The fair value is the initial carrying

amount for the purposes of subsequent accounting for the retained interest as an associate, joint venture or

financial asset. In addition, any amounts previously recognized in other comprehensive income in respect of that

entity are accounted for as if the Group had directly disposed of the related assets or liabilities. This may mean

that amounts previously recognized in other comprehensive income are reclassified to profit or loss.

If the ownership interest in an associate is reduced but significant influence is retained, only a proportionate share

of the amounts previously recognized in other comprehensive income are reclassified to profit or loss where

appropriate.

(iii) Associates

An associate is an entity over which the Group has significant influence, but not control, generally accompanying

a shareholding of between 20% and 50% of the voting rights. Interests in associates are accounted for using

the equity method of accounting and are initially recognized at cost. The Group’s interests in associates include

goodwill identified on acquisition, net of any accumulated impairment losses. See note 2(g) for the impairment of

non-financial assets including goodwill.

The Group’s share of its associates’ post-acquisition profits or losses is recognized in the consolidated income

statement, and its share of post-acquisition movements in other comprehensive income is recognized in other

comprehensive income. The cumulative post-acquisition movements are adjusted against the carrying amount of

the investment. When the Group’s share of losses in an associate equals or exceeds its interest in the associate

including any other unsecured receivables, the Group does not recognize further losses, unless it has incurred

obligations or made payments on behalf of the associate.

Accounting policies of associates have been changed where necessary to ensure consistency with the policies

adopted by the Group.

Unrealized gains on transactions between the Group and its associates are eliminated to the extent of the

Group’s interest in the associates. Unrealized losses are eliminated unless the transaction provides evidence of an

impairment of the assets transferred.

(b) Segment reporting

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating

decision-maker. The chief operating decision-maker, who is responsible for allocating resources and assessing

performance of the operating segments, has been identified as the steering committee that makes strategic decisions.

(c) Translation of foreign currencies

(i) Items included in the financial statements of each of the Group’s entities are measured using the currency of the

primary economic environment in which the entity operates (the “functional currency”). The financial statements of

the Company and of the Group are presented in United States dollars (the “presentation currency”).

(ii) Foreign currency transactions are translated into the functional currency using the exchange rates prevailing at the

dates of the transactions or valuation where items are re-measured. Foreign exchange gains and losses resulting

from the settlement of such transactions and from the translation at year-end exchange rates of monetary assets

and liabilities denominated in foreign currencies are recognized in the income statement, except when deferred in

equity as qualifying cash flow hedges and qualifying net investment hedges.

All foreign exchange gains and losses that relate to bank deposits and cash and cash equivalents are presented in

the income statement within ‘other operating income/(expenses) – net’.

Changes in the fair value of monetary securities denominated in foreign currency classified as available-for-sale are

analyzed between translation differences resulting from changes in the amortized cost of the security and other

changes in the carrying amount of the security. Translation differences related to changes in the amortized cost

are recognized in profit or loss, and other changes in the carrying amount are recognized in other comprehensive

income and included in the investment revaluation reserve in equity.

Translation differences on non-monetary financial assets and liabilities such as equities held at fair value

through profit or loss are recognized in profit or loss as part of the fair value gain or loss. Translation differences

on non-monetary financial assets such as equities classified as available-for-sale are recognized in other

comprehensive income and included in the investment revaluation reserve in equity.