Lenovo 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

132

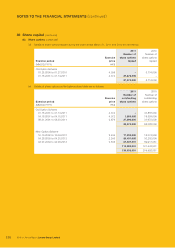

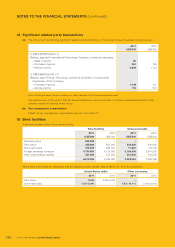

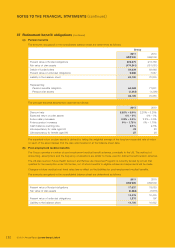

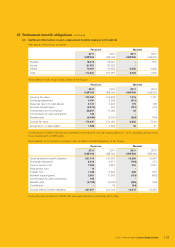

NOTES TO THE FINANCIAL STATEMENTS (continued)

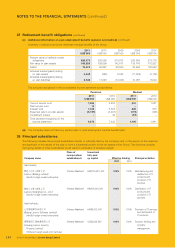

37 Retirement benefit obligations (continued)

(a) Pension benefits

The amounts recognized in the consolidated balance sheet are determined as follows:

Group

2011 2010

US$’000 US$’000

Present value of funded obligations 228,275 213,769

Fair value of plan assets (174,241) (151,081)

Deficit of funded plans 54,034 62,688

Present value of unfunded obligations 9,086 7,547

Liability in the balance sheet 63,120 70,235

Representing:

Pension benefits obligation 64,362 71,631

Pension plan assets (1,242) (1,396)

63,120 70,235

The principal actuarial assumptions used are as follows:

2011 2010

Discount rate 2.25% – 5.0% 2.25% – 5.25%

Expected return on plan assets 0% – 5% 0% – 5%

Future salary increases 2.2% – 3.5% 2.2% – 3.5%

Future pension increases 0% – 1.75% 0% – 1.75%

Cash balance crediting rate 2.5% 2.5%

Life expectancy for male aged 60 23 23

Life expectancy for female aged 60 27 26

The expected return on plan assets is derived by taking the weighted average of the long term expected rate of return

on each of the asset classes that the plan was invested in at the balance sheet date.

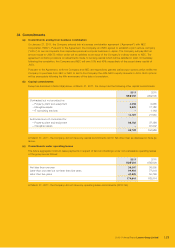

(b) Post-employment medical benefits

The Group operates a number of post-employment medical benefit schemes, principally in the US. The method of

accounting, assumptions and the frequency of valuations are similar to those used for defined benefit pension schemes.

The US plan (Lenovo Future Health Account and Retiree Life Insurance Program) is currently funded by a trust that

qualifies for tax exemption under US tax law, out of which benefits to eligible retirees and dependents will be made.

Changes in future medical cost trend rates has no effect on the liabilities for post-employment medical benefits.

The amounts recognized in the consolidated balance sheet are determined as follows:

2011 2010

US$’000 US$’000

Present value of funded obligations 17,037 18,053

Fair value of plan assets (6,562) (7,618)

10,475 10,435

Present value of unfunded obligations 1,275 197

Liability in the balance sheet 11,750 10,632