Lenovo 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

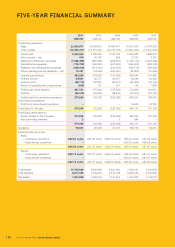

2010/11 Annual Report Lenovo Group Limited 131

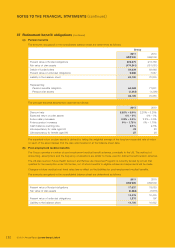

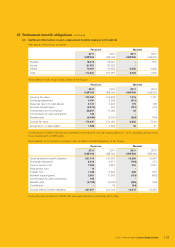

37 Retirement benefit obligations

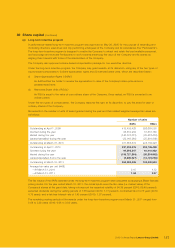

Group

2011 2010

US$’000 US$’000

Pension obligation included in non-current liabilities

Pension benefits 63,120 70,235

Post-employment medical benefits 11,750 10,632

74,870 80,867

Expensed in income statement

Pension benefits (Note 10) 9,878 7,433

Post-employment medical benefits 1,106 1,841

10,984 9,274

Net actuarial loss recognized in other comprehensive

income for the year 7,190 10,840

Cumulative actuarial loss recognized in the

statement of other comprehensive income 11,005 3,815

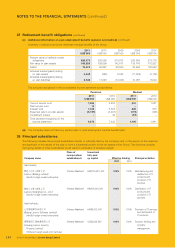

On the acquisition of the personal computer business of IBM, the Group assumed a cash balance pension liability for

substantially all former IBM employees in Japan, and final salary defined benefit obligations for selected employees in other

countries.

In the United States, the Group operates a final-salary pension plan that covers approximately 20% of all employees. These

were former participants in the IBM US pension plan. In addition, the Group operates a supplemental defined benefit plan that

covers certain executives transferred from IBM and is intended to provide benefits in excess of certain US tax and labour law

limits that apply to the pension plan. Both plans are frozen to new participation. However, benefits continue to accrue.

In Germany, the Group operates a sectionalized plan that has both defined contribution and defined benefit features, including

benefits based on a final pay formula. This plan is closed to new entrants.

Participant benefits under the Group plans depend on the provisions of the former IBM plan under which the participant had

been covered. The Group’s major plans are valued by qualified actuaries annually using the projected unit credit method.

Actuarial gains and losses arising from experience adjustments and changes in actuarial assumptions are charged or credited

to other comprehensive income in the period they arise.