Lenovo 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

110

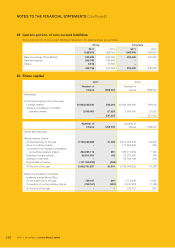

NOTES TO THE FINANCIAL STATEMENTS (continued)

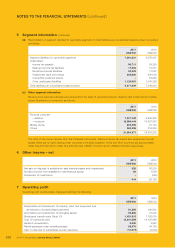

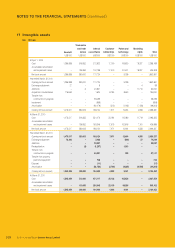

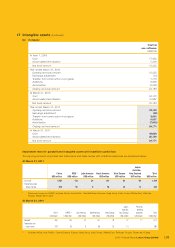

17 Intangible assets (continued)

Impairment tests for goodwill and intangible assets with indefinite useful lives (continued)

Management has completed the allocation of the goodwill attributable to the acquisition of Lenovo Mobile Communication

Limited. The goodwill is primarily attributable to the significant synergies expected to arise in connection with the Group’s

strategic objectives and the development of customer-focused products to capitalize on the mobile internet device business

growth in China. The entire amount of goodwill of US$177 million as at March 31, 2010 has been allocated to the China

market segment during the year.

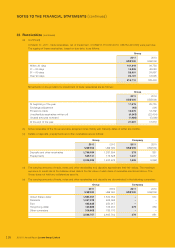

The Group completed its annual impairment test for goodwill allocated to the Group’s various cash generating units (“CGU”)

by comparing their recoverable amounts to their carrying amounts as at the reporting date. The recoverable amount of a

CGU is determined based on value in use. These assessments use pre-tax cash flow projections based on financial budgets

approved by management covering a 5-year period with a terminal value related to the future cash flow of the CGU beyond

the five-year period are extrapolated using the estimated growth rates stated below. The estimated growth rates adopted do

not exceed the long-term average growth rates for the businesses in which the CGU operates.

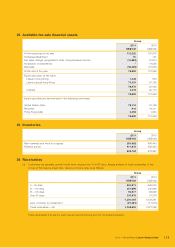

The estimated growth rates used for value-in-use calculations are as follows:

2011 2010

China 21.3% 13.9%

REM 6.2% 9.7%

Latin America 5.0% 2.3%

North America (0.3%) 4.3%

West Europe 5.4% 0.2%

Japan, Australia, New Zealand (4.0%) (3.2%)

Future cash flows are discounted at the standard rate of 11% (2010: 11%) across all CGUs.

Management determined budgeted gross margins based on past performance and its expectations for the market

development. The weighted average growth rates used are consistent with the forecasts included in industry reports. The

discount rates are pre-tax and reflect specific risks relating to the relevant segments.

The directors are of the view that there was no evidence of impairment of goodwill and trademarks and trade names as at

March 31, 2011 arising from the review (2010: Nil).

The Group has performed a sensitivity analysis on key assumptions used for the annual impairment test for goodwill. A

reasonably possible change in key assumptions used in the impairment test for goodwill would not cause any CGU’s carrying

amount to exceed its respective recoverable amount, except for the forecasted operating margins of REM. If such margin had

been one and a half percentage points lower than management’s estimates, the Group would have recognized an impairment

of US$12 million against the goodwill of REM.

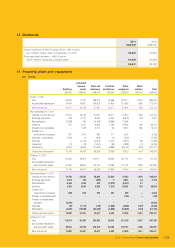

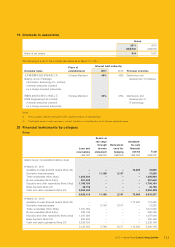

18 Subsidiaries

(a) Investments in subsidiaries

Company

2011 2010

US$’000 US$’000

Unlisted investments, at cost 1,929,073 1,898,912

A summary of the principal subsidiaries of the Company is set out in Note 38.

(b) Amounts due from/to subsidiaries

The amounts are interest-free, unsecured and have no fixed terms of repayment.