Lenovo 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

92

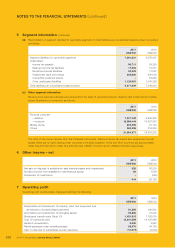

NOTES TO THE FINANCIAL STATEMENTS (continued)

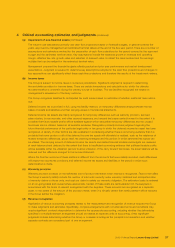

3 Financial risk management

The Group’s activities expose it to a variety of financial risks, such as market risk (including foreign currency risk and

cash flow interest rate risk), credit risk, and liquidity risk. The Group’s overall risk management program focuses on the

unpredictability of financial markets and seeks to minimize potential adverse effects on the Group’s financial performance. The

Group uses derivative financial instruments to hedge certain risk exposures.

Risk management is carried out by a central treasury department (“Group Treasury”) under approved policies. Group Treasury

identifies, evaluates and hedges financial risks in close co-operation with the Group’s operating units. The Group has the

overall risk management such as foreign currency risk, credit risk, interest rate risk, use of derivative financial instruments and

investment of excess liquidity.

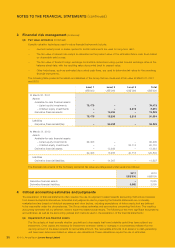

(a) Financial risk factors

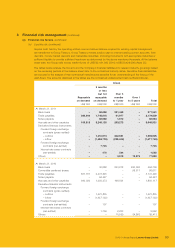

(i) Foreign currency risk

The Group operates internationally and is exposed to foreign currency risk arising from various currency exposures,

primarily with respect to Australian dollar, Canadian dollar, Euro, Japanese Yen, Pound Sterling and Renminbi.

Foreign currency risk arises from future commercial transactions, recognized assets and liabilities and net

investment in foreign operations denominated in a currency that is not the group companies’ functional currencies.

Management has set up a policy to require group companies to manage their foreign currency risk against their

functional currency. The Group’s forward foreign currency contracts are either used to hedge a percentage of

anticipated cash flows (mainly export sales and purchase of inventories) which are highly probable, or used as fair

value hedges for the identified assets and liabilities.

For segment reporting purposes, external hedge contracts on assets, liabilities or future transactions are

designated to each operating segment, as appropriate.

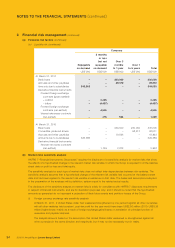

(ii) Cash flow interest rate risk

The Group’s substantial long-term borrowings are denominated in United States dollar. Borrowings denominated

in other currencies are insignificant. It is the Group’s policy to mitigate interest rate risk through the use of

appropriate interest rate hedging instruments. Generally, the Group manages its cash flow interest rate risk by

using floating-to-fixed interest rate swaps. Such interest rate swaps have the economic effect of converting

borrowings from floating rates to fixed rates. Under the interest rate swaps, the Group agrees with other parties to

exchange, at specified intervals (primarily quarterly), the difference between fixed contract rates and floating-rate

interest amounts calculated by reference to the agreed notional amounts.

The Group operates a global channel financing program. The Group is exposed to fluctuation of interest rates of all

the currencies covered by the global channel financing program.

(iii) Credit risk

Credit risk is managed on a group basis. Credit risk arises from cash and cash equivalents, derivative financial

instruments and deposits with banks and financial institutions, as well as credit exposures to customers, including

outstanding receivables and committed transactions.

For banks and other financial institutions, the Group controls its credit risk through monitoring their credit rating

and setting approved counterparty credit limits that are regularly reviewed.

The Group has no significant concentration of customer credit risk. The Group has a credit policy in place and

exposures to these credit risks are monitored on an ongoing basis.

No credit limits were exceeded by any customers during the reporting period, and management does not expect

any losses from non-performance by these counterparties.

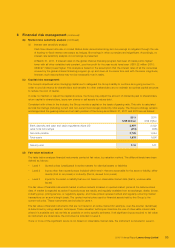

(iv) Liquidity risk

Cash flow forecasting of the Group is performed by Group Treasury. It monitors rolling forecasts of the Group’s

liquidity requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient

headroom on its undrawn committed borrowing facilities (Note 33) at all times so that the Group does not breach

borrowing limits or covenants (where applicable) on any of its borrowing facilities. Such forecasting takes into

consideration the Group’s debt financing plans, covenant compliance, compliance with internal balance sheet ratio

targets and, if applicable external regulatory or legal requirements, for example, currency restrictions.