Lenovo 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

128

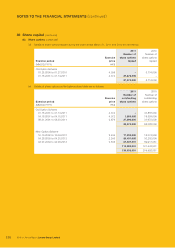

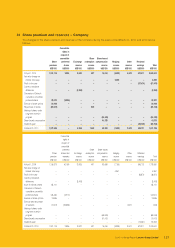

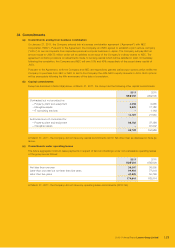

NOTES TO THE FINANCIAL STATEMENTS (continued)

32 Significant related party transactions

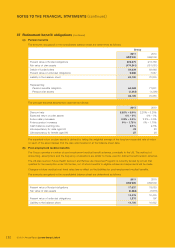

(a) The Group had the following significant related party transactions in the normal course of business during the year:

2011 2010

US$’000 US$’000

北京聯想利泰軟件有限公司

(Beijing Legendsoft International Technology Company Limited) (an associate)

– Sales of goods 60 –

– Purchase of goods 281 165

– Service income 2,024 1,724

北京聯想調頻科技有限公司

(Beijing Legend Tiaopin Technology Limited) (a subsidiary of a substantial

shareholder of the Company)

– Purchase of goods 1,148 141

– Service income 102 573

Note: The English name of each company is a direct translation of its Chinese registered name.

The directors are of the opinion that the above transactions were conducted on normal commercial terms and in the

ordinary course of business of the Group.

(b) Key management compensation

Details on key management compensation are set out in Note 11.

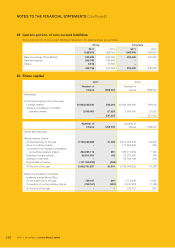

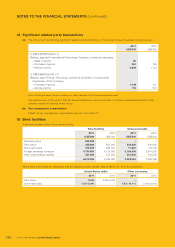

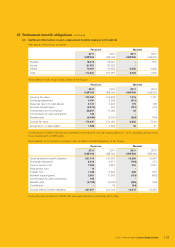

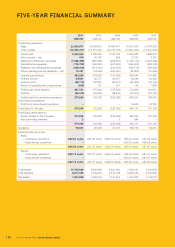

33 Bank facilities

Total bank facilities of the Group are as follows:

Total facilities Utilized amounts

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Revolving loans 800,000 –––

Term loans 300,000 830,000 200,000 430,000

Short-term loans 475,000 485,000 71,561 64,706

Foreign exchange contracts 4,764,000 4,175,000 3,190,000 2,641,000

Other trade finance facilities 331,000 276,000 201,000 191,000

6,670,000 5,766,000 3,662,561 3,326,706

All the bank borrowings are unsecured and the effective annual interest rates at March 31, 2011 are as follows:

United States dollar Other currencies

2011 2010 2011 2010

Term loans 3.5% 3.5%-5.2% ––

Short-term loans 1.5%-2.4% –1.5%-14.1% 5.4%-30.1%