Lenovo 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 133

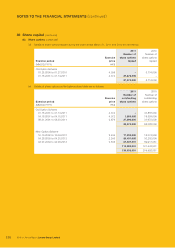

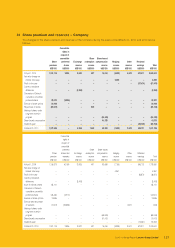

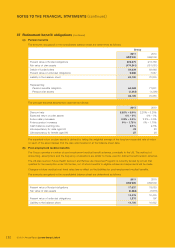

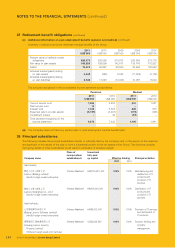

37 Retirement benefit obligations (continued)

(c) Additional information on post-employment benefits (pension and medical)

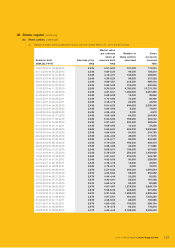

Plan assets of the Group comprise:

Pensions Medical

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Equities 12,613 25,901 –810

Bonds 81,661 83,622 ––

Others 79,967 41,558 6,562 6,808

Total 174,241 151,081 6,562 7,618

Reconciliation of fair value of plan assets of the Group:

Pensions Medical

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Opening fair value 151,081 134,852 7,618 7,761

Exchange adjustment 4,491 6,209 (810) –

Expected return on plan assets 5,197 3,947 179 196

Actuarial (losses)/gains (3,511) 561 (131) (175)

Contributions by the employer 23,367 11,088 30 –

Contributions by plan participants 165 –––

Benefits paid (6,549) (5,576) (324) (164)

Closing fair value 174,241 151,081 6,562 7,618

Actual return on plan assets 1,686 4,508 48 21

Contributions of US$16,364,000 are estimated to be made for the year ending March 31, 2012, excluding amounts due

to be transferred from IBM plans.

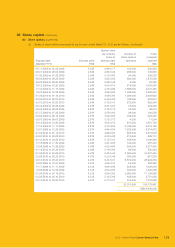

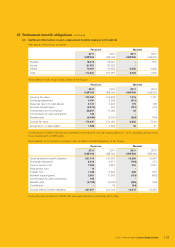

Reconciliation of movements in present value of defined benefit obligations of the Group:

Pensions Medical

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Opening defined benefit obligation 221,316 193,967 18,250 16,646

Exchange adjustment 3,918 9,677 (766) 373

Current service cost 7,655 4,833 551 1,221

Past service cost 14 –––

Interest cost 7,406 6,505 828 816

Actuarial losses/(gains) 3,681 11,868 (133) (642)

Contributions by plan participants 165 –––

Benefits paid (6,794) (5,576) (324) (164)

Curtailments –42 (94) –

Closing defined benefit obligation 237,361 221,316 18,312 18,250

During the year benefits of US$245,000 were paid directly by the Group (2010: Nil).