Lenovo 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

134

NOTES TO THE FINANCIAL STATEMENTS (continued)

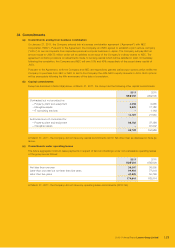

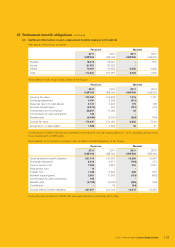

37 Retirement benefit obligations (continued)

(c) Additional information on post-employment benefits (pension and medical) (continued)

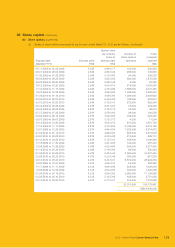

Summary of pensions and post-retirement medical benefits of the Group:

2011 2010 2009 2008 2007

US$’000 US$’000 US$’000 US$’000 US$’000

Present value of defined benefit

obligations 255,673 239,566 210,613 220,650 213,775

Fair value of plan assets 180,803 158,699 142,613 135,160 110,827

Deficit 74,870 80,867 68,000 85,490 102,948

Actuarial losses/(gains) arising

on plan assets 3,642 (386) 6,023 (11,384) (2,152)

Actuarial losses/(gains) arising

on plan liabilities 3,548 11,226 (13,048) 10,081 8,040

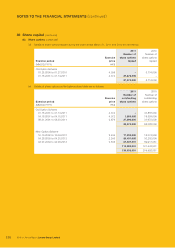

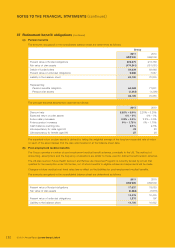

The amounts recognized in the consolidated income statement are as follows:

Pensions Medical

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Current service cost 7,655 4,833 551 1,221

Past service cost 14 –––

Interest cost 7,406 6,505 828 816

Expected return on plan assets (5,197) (3,947) (179) (196)

Curtailment losses –42 (94) –

Total expense recognized in the

income statement 9,878 7,433 1,106 1,841

(d) The Company does not have any pension plan or post-employment medical benefits plan.

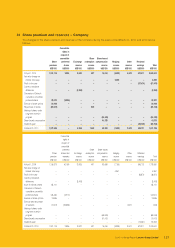

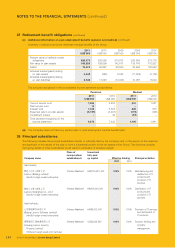

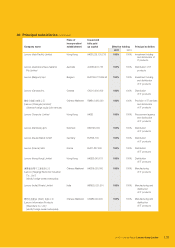

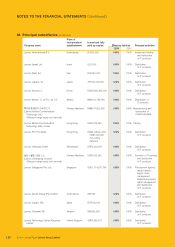

38 Principal subsidiaries

The following includes the principal subsidiaries directly or indirectly held by the Company and, in the opinion of the directors,

are significant to the results of the year or form a substantial portion of the net assets of the Group. The directors consider

that giving details of other subsidiaries would result in particulars of excessive length.

Company name

Place of

incorporation/

establishment

Issued and

fully paid

up capital Effective holding Principal activities

2011 2010

Held directly:

聯想(北京)有限公司

(Lenovo (Beijing) Limited)1

(wholly foreign-owned enterprise)

Chinese Mainland HK$175,481,300 100% 100% Manufacturing and

distribution of IT

products and

provision of IT

services

聯想(上海)有限公司

(Lenovo (Shanghai) Co., Ltd.)1

(wholly foreign-owned enterprise)

Chinese Mainland HK$10,000,000 100% 100% Distribution of IT

products and

provision of IT

services

Held indirectly:

北京聯想軟件有限公司

(Beijing Lenovo Software Limited)1

(wholly foreign-owned enterprise)

Chinese Mainland HK$5,000,000 100% 100% Provision of IT services

and distribution of

IT products

惠陽聯想工業物業有限公司

(Huiyang Lenovo Industry

Property Limited)1

(Chinese-foreign equity joint venture)

Chinese Mainland US$2,045,500 100% 100% Property holding and

property

management