Lenovo 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

114

NOTES TO THE FINANCIAL STATEMENTS (continued)

21 Deferred income tax assets and liabilities (continued)

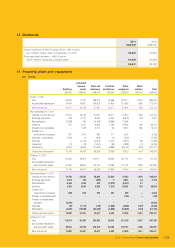

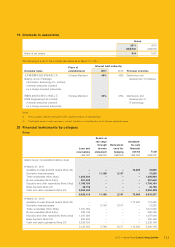

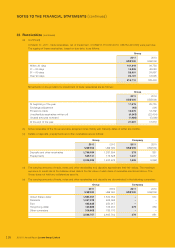

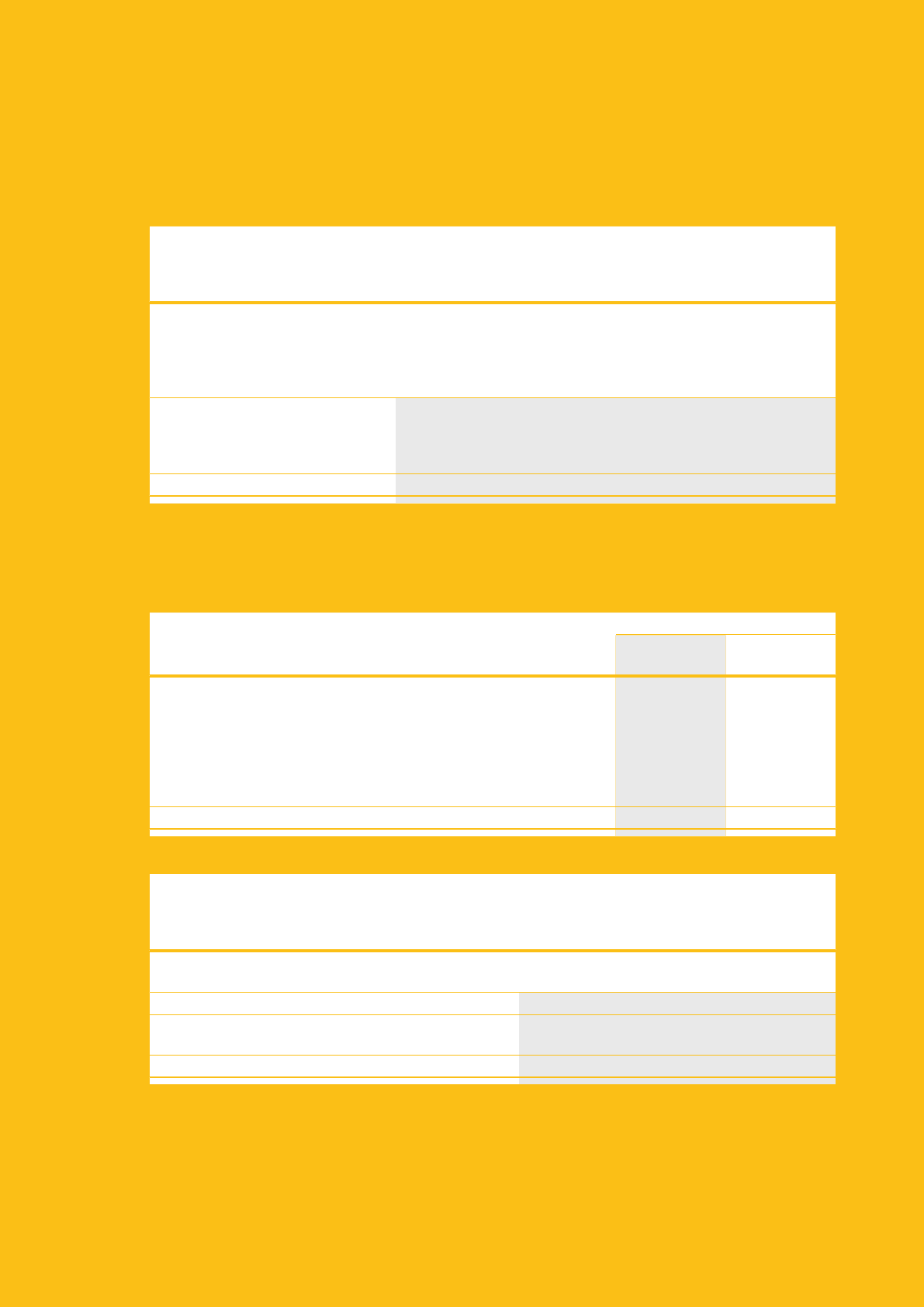

(a) The movements in deferred income tax assets, analyzed by major component, during the year are as follows:

Provisions

and accruals Tax losses

Accelerated

accounting

depreciation

Deferred

revenue Total

US$’000 US$’000 US$’000 US$’000 US$’000

At April 1, 2009 122,036 19,519 3,823 45,466 190,844

Acquisition of subsidiaries 6,000 6,327 – – 12,327

Reclassification and exchange adjustment (11,624) 9,079 1,419 1,763 637

Credited/(debited) to consolidated

income statement 21,595 (11,025) 4,191 36,409 51,170

At March 31, 2010 and April 1, 2010 138,007 23,900 9,433 83,638 254,978

Reclassification and exchange adjustment (1,003) (3,741) 432 10,753 6,441

Credited/(debited) to consolidated

income statement 13,416 5,297 (1,735) (27,299) (10,321)

At March 31, 2011 150,420 25,456 8,130 67,092 251,098

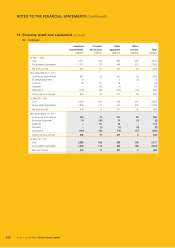

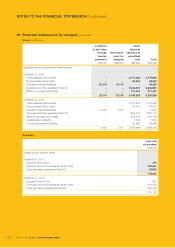

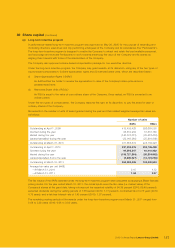

Deferred income tax assets are recognized for deductible temporary differences and tax losses carried forward to the

extent that realization of the related tax benefit through the future taxable profits is probable. At March 31, 2011, the

Group did not recognize deferred income tax assets in respect of tax losses of approximately US$751,904,000 (2010:

US$849,311,000) that can be carried forward against future taxable income, of which, tax losses of US$659,254,000

(2010: US$737,480,000) can be carried forward indefinitely. The remaining balances of tax losses will expire as follows:

Group

2011 2010

US$’000 US$’000

Expiring in

– 2014 16,263 6,556

– 2015 7,146 52,582

– 2016 5,616 10,392

– 2017 42,098 42,301

– 2018 13,108 –

– 2019 8,419 –

92,650 111,831

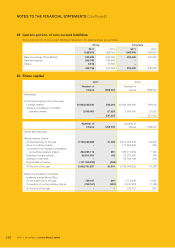

(b) The movements in deferred income tax liabilities, analyzed by major component, during the year are as follows:

Accelerated

tax

depreciation

Undistributed

earnings Total

US$’000 US$’000 US$’000

At April 1, 2009 –––

Debited to consolidated income statement –10,331 10,331

At March 31, 2010 and April 1, 2010 –10,331 10,331

Exchange adjustment 8128 136

Debited to consolidated income statement 475 6,151 6,626

At March 31, 2011 483 16,610 17,093