Lenovo 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 61

Directors’ Rights to Acquire Shares or Debentures (continued)

Share Option Schemes (continued)

4. Valuation of share options

The share options granted are not recognized in the financial statements until they are exercised. The directors consider

that it is not appropriate to value the share options on the ground that certain crucial factors for such valuation are variables

which cannot be reasonably determined at this stage. Any valuation of the share options based on speculative assumptions

in respect of such variables would not be meaningful and the results thereof may be misleading to the shareholders. Thus, it

is more appropriate to disclose only the market price and exercise price.

Long-term incentive program

The Company adopted the LTI Program on May 26, 2005, under which the Board or the trustee of the program shall select the

employees (including but not limited to the directors) of the Group for participation in the program, and determine the number of

shares to be awarded.

Details of the program and the movement in the number of awards for the year ended March 31, 2011 are set out in the Corporate

Governance section on pages 38 to 41 and note 30(a) to the financial statements.

Apart from the share option schemes and the LTI Program, at no time during the year ended March 31, 2011 was the Company

or any of its subsidiaries a party to any arrangements to enable the directors of the Company to acquire benefits by means of

acquisitions of shares in, or debentures of, the Company or any body corporate.

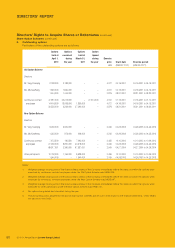

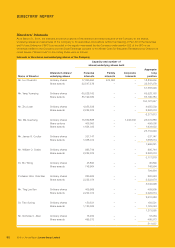

Purchase, Sale, Redemption or Conversion of the Company’s Securities

During the year, the Company purchased 157,760,000 ordinary shares of HK$0.025 each in the capital of the Company at prices

ranging from HK$3.94 to HK$4.60 per share on The Stock Exchange of Hong Kong Limited.

Month/Year

Number of

shares

repurchased

Highest price

per share

Lowest price

per share

Aggregate

Consideration

paid (excluding

expenses)

HK$ HK$ HK$

6/2010 34,456,000 4.50 4.17 149,427,360

7/2010 43,026,000 4.49 4.11 185,729,660

8/2010 6,000,000 4.53 4.41 26,738,540

9/2010 5,852,000 4.60 4.42 26,391,160

3/2011 68,426,000 4.38 3.94 284,393,100

The repurchased shares were cancelled and accordingly, the issued share capital of the Company was diminished by the nominal

value thereof. The premium payable on repurchase was charged against the share premium account of the Company.

On November 15, 2010, group companies/funds of TPG Capital, Newbridge Capital and General Atlantic, the holders of the

Company’s convertible preferred shares, converted 769,167 convertible preferred shares into 282,263,115 fully paid ordinary

shares of the Company.

Save as disclosed above, neither the Company nor any of its subsidiaries purchased, sold or redeemed any of the Company’s

securities during the year ended March 31, 2011.