Lenovo 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

98

NOTES TO THE FINANCIAL STATEMENTS (continued)

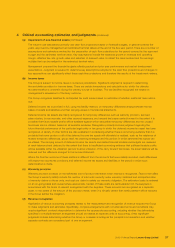

4 Critical accounting estimates and judgments (continued)

(d) Revenue recognition (continued)

The Group sells products to channels. Sales through channels are primarily made under agreements allowing for limited

rights of sales return, volume discounts, price protection and rebates, and marketing development funds. The Group’s

policy for sales to channels is to defer, until the return period is over, the full amount of revenue relative to sales for

which the rights of return apply unless there is sufficient historical data to establish reasonable and reliable estimates

of customer returns which include estimated return rates as well as the number of units shipped that still have a right

of return as of the balance sheet date. Revenue recognition is also impacted by the Group’s ability to estimate volume

discounts, price protection and rebates, and marketing development funds. The Group considers various factors,

including a review of specific transactions, historical experience and market and economic conditions when calculating

these provisions and allowances.

Revenue from sales of goods is recognized when both ownership and risk of loss are effectively transferred to customer.

Risk of loss associated with goods-in-transit is generally retained by the Group. The Group books revenue upon delivery

of products, and defers the amounts of revenue based on the estimated days-in-transit at the end of each month. The

days-in-transit is estimated based on the Group’s weighted average estimated time of shipment arrival. Cost of in-transit

products is deferred in deposits, prepayment and other receivables in the balance sheet until revenue is recognized. The

estimates of days-in-transit are reviewed semi-annually.

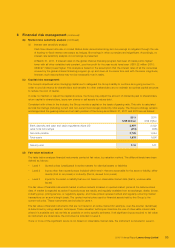

(e) Retirement benefits

Pension and other post-retirement benefit costs and obligations are dependent on various assumptions. The Group’s

major assumptions primarily relate to discount rate, expected return on assets, and salary growth. In determining the

discount rate, the Group references market yields at the balance sheet date on high quality corporate bonds. The

currency and term of the bonds are consistent with the currency and estimated term of the benefit obligations being

valued. The expected return on plan assets is based on market expectations for returns over the life of the related

assets and obligations. The salary growth assumptions reflect the Group’s long-term actual experience and future and

near-term outlook. Actual results that differ from the assumptions are generally recognized in the year they occur.

(f) Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives)

is determined by using valuation techniques. The Group uses its judgment to select a variety of methods and make

assumptions that are mainly based on market conditions existing at each balance sheet date. The Group has used

discounted cash flow analysis for various available-for-sale financial assets that are not traded in active markets.

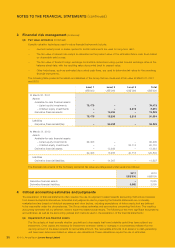

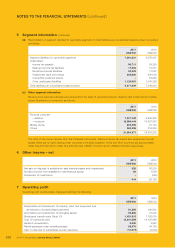

5 Segment information

Management has determined the operating segments based on the reports reviewed by the Lenovo Executive Committee (the

“LEC”), the chief operating decision-maker, that are used to make strategic decisions.

The LEC considers business from a market perspective. The Group has three market segments, China, emerging markets

(excluding China) and mature markets, which are also the Group’s reportable operating segments.

The LEC assesses the performance of the operating segments based on a measure of adjusted pre-tax income/(loss).

This measurement basis excludes the effects of non-recurring expenditure such as restructuring costs from the operating

segments. The measurement basis also excludes the effects of unrealized gains/losses on financial instruments. Interest

income and expenditure are not allocated to segments, as this type of activity is driven by the central treasury function, which

manages the cash position of the Group.

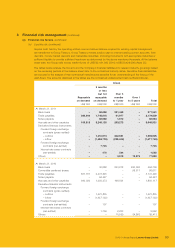

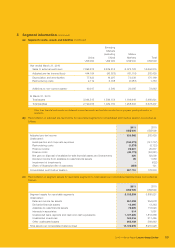

(a) Segment results, assets and liabilities

The segment information provided to the LEC for the reportable segments are as follows:

China

Emerging

Markets

(excluding

China)

Mature

Markets Total

US$’000 US$’000 US$’000 US$’000

Year ended March 31, 2011

Sales to external customers 10,015,371 3,859,739 7,719,261 21,594,371

Adjusted pre-tax income/(loss) 507,497 (64,669) 77,734 520,562

Depreciation and amortization 71,380 22,017 82,743 176,140

Restructuring costs –(51) 398 347

Additions to non-current assets* 46,256 6,305 15,510 68,071

At March 31, 2011

Total assets 4,029,553 2,768,369 1,387,477 8,185,399

Total liabilities 3,036,757 2,789,863 1,564,411 7,391,031