Lenovo 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

130

NOTES TO THE FINANCIAL STATEMENTS (continued)

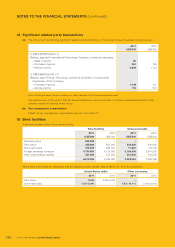

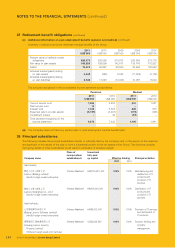

35 Contingent liabilities

(a) The Group, in the ordinary course of its business, is involved in various claims, suits, investigations, and legal

proceedings that arise from time to time. Although the Group does not expect that the outcome in any of these other

legal proceedings, individually or collectively, will have a material adverse effect on its financial position or results of

operations, litigation is inherently unpredictable. Therefore, the Group could incur judgments or enter into settlements of

claims that could adversely affect its operating results or cash flows in a particular period.

(b) The Company has executed guarantees with respect to bank facilities made available to its subsidiaries. At March 31,

2011, such facilities granted and utilized amounted to approximately US$2,146,903,000 and US$1,249,895,000 (2010:

US$1,653,268,000 and US$1,101,677,000) respectively.

(c) The Company has issued letters of guarantee to certain suppliers and vendors of its subsidiaries. At March 31, 2011,

the guarantees were expired (2010: US$100,000,000 granted and fully utilized).

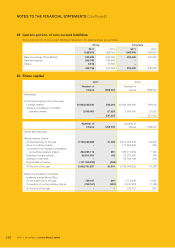

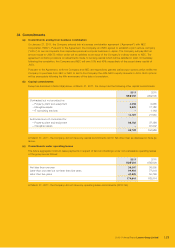

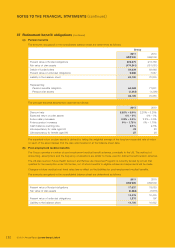

36 Notes to the consolidated cash flow statement

(a) Reconciliation of profit before taxation to net cash generated from operations

2011 2010

US$’000 US$’000

Profit before taxation 357,751 176,303

Share of losses/(profits) of associates 225 (121)

Finance income (24,927) (20,377)

Finance costs 49,176 62,881

Depreciation of property, plant and equipment and

amortization of prepaid lease payments 81,856 100,826

Amortization of intangible assets and share-based compensation 135,659 120,756

(Gain)/loss on disposal of property, plant and equipment

and prepaid lease payments (191) 3,369

Loss on disposal of construction-in-progress 1,415 748

Gain on disposal of intangible assets (14) –

Gain on disposal of subsidiaries and an associate (13,015) (2,600)

Impairment of assets –6,624

Dividend income (93) (1,558)

Gain on disposal of financial instruments (326) (82,090)

Decrease/(increase) in inventories 75,185 (401,082)

Increase in trade receivables, notes receivable, deposits,

prepayments and other receivables (1,238,985) (1,086,354)

Increase in trade payables, notes payable, provisions,

accruals and other payables 1,761,769 2,183,039

Effect of foreign exchange rate changes (96,388) (83,491)

Net cash generated from operations 1,089,097 976,873

(b) Changes in bank borrowings

2011 2010

US$’000 US$’000

Change in short-term bank loans 6,855 16,116

Repayment of borrowings (230,000) (235,000)

(223,145) (218,884)