Lenovo 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 93

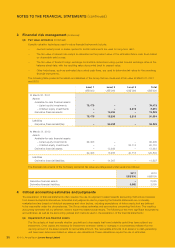

3 Financial risk management (continued)

(a) Financial risk factors (continued)

(iv) Liquidity risk (continued)

Surplus cash held by the operating entities over and above balance required for working capital management

are transferred to Group Treasury. Group Treasury invests surplus cash in interest bearing current accounts, time

deposits, money market deposits and marketable securities, choosing instruments with appropriate maturities or

sufficient liquidity to provide sufficient headroom as determined by the above-mentioned forecasts, At the balance

sheet date, the Group held money market funds of US$732,181,000 (2010: US$530,429,000) (Note 25).

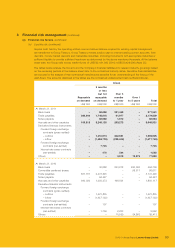

The tables below analyze the Group’s and the Company’s financial liabilities into relevant maturity groupings based

on the remaining periods at the balance sheet date to the contractual maturity dates. Derivative financial liabilities

are included in the analysis if their contractual maturities are essential for an understanding of the timing of the

cash flows. The amounts disclosed in the tables are the contractual undiscounted cash outflows/(inflows).

Group

Repayable

on demand

3 months

or less

but not

repayable

on demand

Over 3

months

to 1 year

Over 1

to 5 years Total

US$’000 US$’000 US$’000 US$’000 US$’000

At March 31, 2011

Bank loans –50,098 221,463 –271,561

Trade payables 369,244 1,748,618 61,977 –2,179,839

Notes payable –96,992 1,972 –98,964

Accruals and other payables 109,513 3,246,135 293,273 –3,648,921

Derivative financial instruments

Forward foreign exchange

contracts (gross-settled)

– outflow –1,451,974 242,931 –1,694,905

– inflow –(1,438,703) (239,040) –(1,677,743)

Forward foreign exchange

contracts (net-settled) –7,725 – – 7,725

Interest rate swap contracts

(net-settled) –476 544 –1,020

Others – – 3,913 73,976 77,889

At March 31, 2010

Bank loans –30,888 263,818 200,000 494,706

Convertible preferred shares – – – 98,611 98,611

Trade payables 667,781 2,473,645 – – 3,141,426

Notes payable –94,427 – – 94,427

Accruals and other payables 360,020 1,293,273 196,824 –1,850,117

Derivative financial instruments

Forward foreign exchange

contracts (gross-settled)

– outflow –1,421,835 – – 1,421,835

– inflow –(1,427,122) – – (1,427,122)

Forward foreign exchange

contracts (net-settled) –107 – – 107

Interest rate swap contracts

(net-settled) –1,759 2,203 –3,962

Others – – 10,550 24,863 35,413