Lenovo 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 17

In January 2011, Lenovo announced an agreement to establish

a strategic joint venture with NEC Corporation (NEC). This joint

venture would create the largest PC group in Japan, giving both

Lenovo and NEC a unique opportunity to grow their commercial

and consumer PC businesses in the world’s third largest PC

market through a stronger market position, enhanced product

portfolios, and expanded distribution channels. The anticipated

completion of the transaction is on or about June 30, 2011.

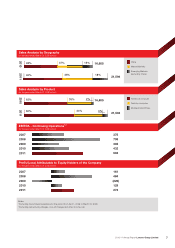

For the fiscal year ended March 31, 2011, the Group’s sales

increased by 30.0 percent year-on-year to US$21,594 million.

Sales of the Group’s PC business were US$20,790 million,

representing a year-on-year increase of 25.9 percent, as its

growth in PC unit shipments was partially offset by lower

average selling price of the products. The mobile business

recorded its first full fiscal year contribution following acquisition

with sales of US$804 million. The Group’s gross profit

increased by 32.1 percent year-on-year to US$2,364 million

and gross margin increased from 10.8 percent in the previous

fiscal year to 10.9 percent. The Group’s effective margin

management, increased mix of the Think branded products

and improved overall competitiveness contributed to the gross

margin expansion.

The Group also continued its stringent expense control during

the fiscal year, while still making significant strategic investments

in product innovation, corporate branding, and promotions of

LePhone and LePad. These investments are intended to drive

long-term, sustainable growth and better profitability in the

future. The Group’s operating expenses excluding restructuring

charges and one-off items increased by 24.7 percent year-on-

year to US$1,978 million. As a result, Lenovo’s expense-to-

revenue ratio was down from 9.6 percent in the previous fiscal

year to 9.2 percent, a historic low level since the IBM PCD

acquisition in 2005. The Group reported profit before taxation

of US$358 million and profit attributable to equity holders

of US$273 million, increases of 102.9 and 111.2 percent,

respectively, from the previous fiscal year.

PERFORMANCE OF GEOGRAPHIES

During the year ended March 31, 2011, Lenovo achieved

strong performance in all geographies where it has operations,

gaining PC market share across the board in China, Emerging

Markets (excluding China) and Mature Markets, benefiting from

its focus on strategic priorities and solid execution. The Group’s

China business continued to perform well and recorded another

historic high in PC market share. Emerging Markets (excluding

China) continued expanding faster than the overall market under

the Group’s attack strategy to grow share in this geography

while operating loss incurred narrowed significantly. Capitalizing

on the recovery of corporate PC demand, Mature Markets

returned to profit, and its operating margin improved in each

quarter during the fiscal year.

China

Overall, China accounted for 46.4 percent of the Group’s total

sales. The PC and mobile businesses in this country accounted

for 42.7 percent and 3.7 percent of the Group’s total sales,

respectively.

During the fiscal year, China PC market continued to maintain

a growth premium against worldwide PC market, but the

expansion in unit shipments slowed to 12.4 percent year-on-

year. The softening of PC demand in China was due to several

factors, including the high year-on-year comparison base,

slower consumer spending due to volatility in the domestic

stock and real estate markets, and continued government

measures to tighten market liquidity and curb inflation.

Lenovo continued to grow faster than the market and

further extended its leadership in China by protecting its

market positions in key cities, and simultaneously attacking

opportunities arising from increasing PC penetration in emerging

smaller cities and rural areas. Lenovo extended its channel

structure in China to increase the chain-store retailer mix in

key cities, expand store front coverage in emerging cities and

grow its network of channel partners focusing on the small-

to-medium sized business (SMB) segment. Lenovo’s unit

shipments growth in China was 22.2 percent year-on-year for

the fiscal year and market share increased by 2.4 percentage-

Lenovo’s MIDH Group kickoff