Lenovo 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

88

NOTES TO THE FINANCIAL STATEMENTS (continued)

2 Significant accounting policies (continued)

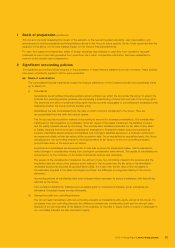

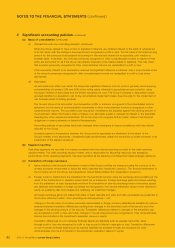

(m) Cash and cash equivalents

For the purposes of the cash flow statement, cash and cash equivalents mainly comprise cash on hand, deposits held

at call with banks, highly liquid investments which are subject to an insignificant risk of changes in value, and bank

overdrafts. Bank overdrafts are shown within borrowings in current liabilities on the balance sheet.

(n) Share capital

Ordinary shares are classified as equity.

Convertible preferred shares are mandatorily redeemable on a specific date. The fair value of the liability portion

of convertible preferred shares is determined using a market interest rate for an equivalent non-convertible bond.

This amount is recorded as a liability on an amortized cost basis until extinguished on conversion or maturity of the

convertible preferred shares (Note 2(o)). The remainder of the proceeds is allocated to the conversion option. This is

recognized and included in shareholders’ equity, net of income tax effects. Upon conversion of convertible preferred

shares to voting ordinary shares, the amounts of liability portion and equity portion of respective preferred shares are

reclassified to share capital and share premium.

The dividends on these convertible preferred shares are recognized in the income statement as interest expense.

Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction, net of

tax, from the proceeds.

Where any group company purchases the Company’s equity share capital (treasury shares), the consideration paid,

including any directly attributable incremental costs (net of income taxes), is deducted from equity attributable to the

Company’s equity holders until the shares are cancelled or reissued. Where such shares are subsequently reissued, any

consideration received (net of any directly attributable incremental transaction costs and the related income tax effects)

is included in equity attributable to the Company’s equity holders.

(o) Borrowings

Borrowings are recognized initially at fair value, net of transaction costs incurred. Transaction costs are incremental

costs that are directly attributable to the acquisition, issue or disposal of a financial asset or financial liability, including

fees and commissions paid to agents, advisers, brokers and dealers, levies by regulatory agencies and securities

exchanges, and transfer taxes and duties. Borrowings are subsequently stated at amortized cost; any difference

between the proceeds (net of transaction costs) and the redemption value is recognized in the income statement over

the period of the borrowings using the effective interest method.

Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement of the

liability for at least 12 months after the balance sheet date.

(p) Trade and other payables

Trade payables are obligations to pay for part components or services that have been acquired in the ordinary course

of business from suppliers. Majority of other payables are obligations to pay for finished goods that have been acquired

in the ordinary course of business from subcontractors. Trade and other payables are classified as current liabilities

if payment is due within one year or less (or in the normal operating cycle of the business if longer). If not, they are

presented as non-current liabilities.

Trade and other payables are recognized initially at fair value and subsequently measured at amortized cost using the

effective interest method.

(q) Provisions

Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement is

determined by considering the class of obligations as a whole. A provision is recognized even if the likelihood of an

outflow with respect to any one item included in the same class of obligations may be small.

Provisions are measured at the present value of the expenditures expected to be required to settle the obligation using

a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the

obligation. The increase in the provision due to passage of time is recognized as interest expense.

(i) Warranty provision

The Group records warranty liabilities at the time of sale for the estimated costs that will be incurred under its basic

limited warranty. The specific warranty terms and conditions vary depending upon the product and the country in

which it was sold, but generally includes technical support, repair parts and labor associated with warranty repair

and service actions. The period ranges from one to three years. The Group reevaluates its estimates on a quarterly

basis to assess the adequacy of its recorded warranty liabilities and adjusts the amounts as necessary.