Lenovo 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 99

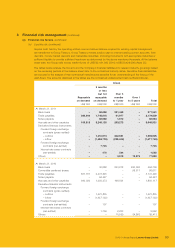

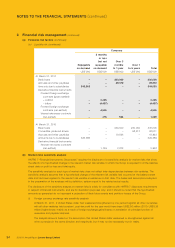

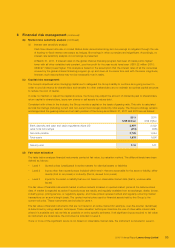

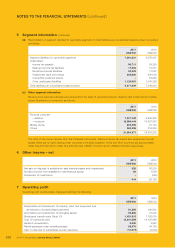

5 Segment information (continued)

(a) Segment results, assets and liabilities (continued)

China

Emerging

Markets

(excluding

China)

Mature

Markets Total

US$’000 US$’000 US$’000 US$’000

Year ended March 31, 2010

Sales to external customers 7,892,275 2,639,812 6,072,728 16,604,815

Adjusted pre-tax income/(loss) 444,164 (96,625) (65,119) 282,420

Depreciation and amortization 77,833 19,297 73,039 170,169

Restructuring costs 2,112 5,708 (6,087) 1,733

Additions to non-current assets* 49,017 3,540 20,085 72,642

At March 31, 2010

Total assets 3,094,515 1,586,158 1,199,948 5,880,621

Total liabilities 2,190,074 1,929,730 1,258,603 5,378,407

* Other than financial instruments and deferred income tax assets; and exclude construction-in-progress pending allocation to

segments.

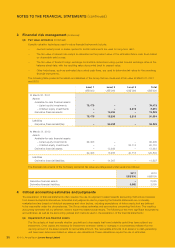

(b) Reconciliation of adjusted pre-tax income for reportable segments to consolidated profit before taxation is provided as

follows:

2011 2010

US$’000 US$’000

Adjusted pre-tax income 520,562 282,420

Unallocated:

Headquarters and corporate expenses (134,879) (141,737)

Restructuring costs (3,878) (5,123)

Finance income 24,927 20,377

Finance costs (49,175) (62,881)

Net gain on disposal of available-for-sale financial assets and investments 326 82,090

Dividend income from available-for-sale financial assets 93 1,558

Impairment of investments –(522)

Share of (losses)/profits of associates (225) 121

Consolidated profit before taxation 357,751 176,303

(c) Reconciliation of segment assets for reportable segments to total assets per consolidated balance sheet is provided as

follows:

2011 2010

US$’000 US$’000

Segment assets for reportable segments 8,185,399 5,880,621

Unallocated:

Deferred income tax assets 251,098 254,978

Derivative financial assets 13,295 13,283

Available-for-sale financial assets 78,689 112,520

Interests in associates 914 1,061

Unallocated bank deposits and cash and cash equivalents 1,727,569 1,813,368

Unallocated inventories 180,516 311,455

Other unallocated assets 268,459 568,642

Total assets per consolidated balance sheet 10,705,939 8,955,928