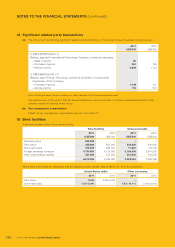

Lenovo 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 121

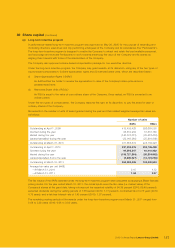

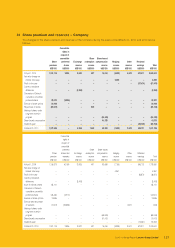

30 Share capital (continued)

(a) Long-term incentive program

A performance-related long-term incentive program was approved on May 26, 2005 for the purpose of rewarding and

motivating directors, executives and top-performing employees of the Company and its subsidiaries (the “Participants”).

The long-term incentive program is designed to enable the Company to attract and retain the best available personnel,

and encourage and motivate Participants to work towards enhancing the value of the Company and its shares by

aligning their interests with those of the shareholders of the Company.

The Company also approved a share-based compensation package for non-executive directors.

Under the long-term incentive program, the Company may grant awards, at its discretion, using any of the two types of

equity-based compensation: (i) share appreciation rights and (ii) restricted share units, which are described below:

(i) Share Appreciation Rights (“SARs”)

An SAR entitles the holder to receive the appreciation in value of the Company’s share price above a

predetermined level.

(ii) Restricted Share Units (“RSUs”)

An RSU is equal to the value of one ordinary share of the Company. Once vested, an RSU is converted to an

ordinary share.

Under the two types of compensation, the Company reserves the right, at its discretion, to pay the award in cash or

ordinary shares of the Company.

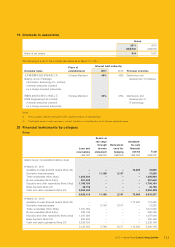

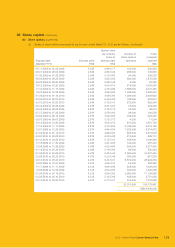

Movements in the number of units of award granted during the year and their related weighted average fair values are

as follows:

Number of units

SARs RSUs

Outstanding at April 1, 2009 413,435,428 282,681,530

Granted during the year 96,610,284 61,351,183

Vested during the year (140,174,073) (93,518,476)

Lapsed/cancelled during the year (32,018,260) (25,804,809)

Outstanding at March 31, 2010 337,853,379 224,709,428

Outstanding at April 1, 2010 337,853,379 224,709,428

Granted during the year 69,595,347 61,441,432

Vested during the year (133,727,293) (83,219,962)

Lapsed/cancelled during the year (9,828,947) (13,100,058)

Outstanding at March 31, 2011 263,892,486 189,830,840

Average fair value per unit (HK$)

– At March 31, 2010 2.15 4.33

– At March 31, 2011 1.53 3.47

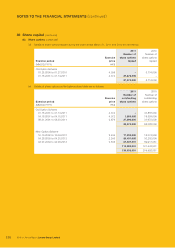

The fair values of the SARs awarded under the long-term incentive program were calculated by applying a Black-Scholes

pricing model. For the year ended March 31, 2011, the model inputs were the fair value (i.e. market value) of the

Company’s shares at the grant date, taking into account the expected volatility of 64.39 percent (2010: 69.45 percent),

expected dividends during the vesting periods of 1.58 percent (2010: 1.77 percent), contractual life of 4.75 years (2010:

4.75 years), and a risk-free interest rate of 1.45 percent (2010: 1.37 percent).

The remaining vesting periods of the awards under the long-term incentive program as at March 31, 2011 ranged from

0.08 to 3.92 years (2010: 0.08 to 3.92 years).