Lenovo 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 119

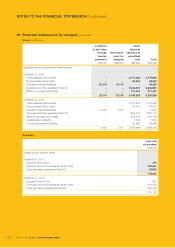

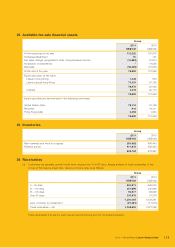

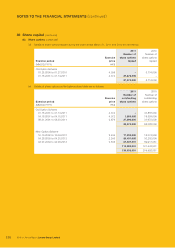

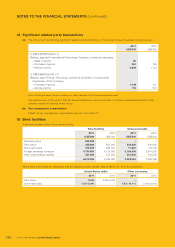

28 Borrowings

(a) Bank borrowings

Group Company

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Term loans (i) (Note 29) 200,000 230,000 200,000 230,000

Term loans (syndicated) (ii) –200,000 –200,000

Short-term loans (iii) 71,561 64,706 ––

271,561 494,706 200,000 430,000

Notes:

(i) Term loans comprise a US$200 million (2010: US$200 million) 3-year term loan facility with a bank in China obtained in March

2009. The 5-year fixed rate loan facility with a bank in China of US$30 million as at March 31, 2010 was fully repaid during the

year. (Note 29).

(ii) Syndicated loans of US$200 million as at March 31, 2010 represent 5-year loan facility from syndicated banks and was fully repaid

during the year.

(iii) Majority of the short-term loans are denominated in United States dollar.

The exposure of the bank borrowings of the Group and the Company to interest rate changes and the contractual

repricing dates at the end of the reporting period are as follows:

Group Company

2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000

Within 1 year 271,561 294,706 200,000 230,000

Between 2 and 5 years –200,000 –200,000

271,561 494,706 200,000 430,000

The carrying amounts of bank borrowings approximate their fair value as the impact of discounting is not significant.

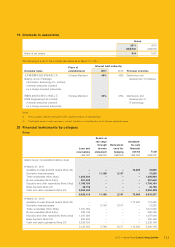

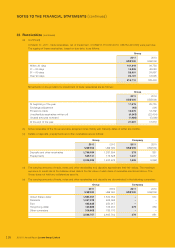

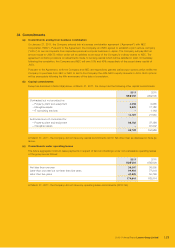

(b) Convertible preferred shares

On May 17, 2005, the Company issued 2,730,000 convertible preferred shares at the stated value of HK$1,000 per

share and unlisted warrants to subscribe for 237,417,474 ordinary shares in the Company for an aggregate cash

consideration of approximately US$350 million. The convertible preferred shares bear a fixed cumulative preferential

cash dividend, payable quarterly, at the rate of 4.5 percent per annum on the stated value of each convertible preferred

share. The convertible preferred shares are redeemable, in whole or in part, at a price equal to the issue price together

with accrued and unpaid dividends at the option of the Company or the convertible preferred shareholders at any time

after the maturity date at May 17, 2012. The warrant holders are entitled to subscribe for 237,417,474 shares in the

Company at HK$2.75 per share.

All warrants were either exercised or repurchased by the Company; and all remaining convertible preferred shares were

converted into voting ordinary shares during the year.

Movements of the liability component of the convertible preferred shares during the year are as follows:

2011 2010

US$’000 US$’000

At the beginning of the year 94,980 215,974

Exchange adjustment 62 (280)

Interest charged 3,810 10,915

Interest paid (2,724) (7,925)

Conversion to voting ordinary shares (96,128) (123,704)

At the end of the year –94,980