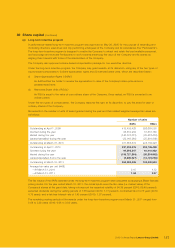

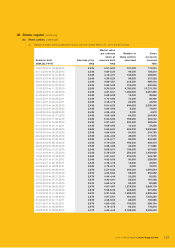

Lenovo 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 115

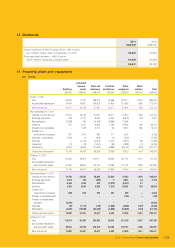

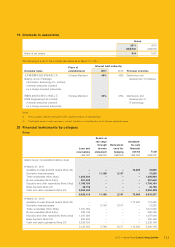

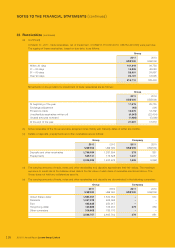

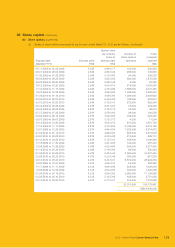

22 Available-for-sale financial assets

Group

2011 2010

US$’000 US$’000

At the beginning of the year 112,520 101,916

Exchange adjustment 81 191

Fair value change recognized in other comprehensive income (15,892) 67,674

Acquisition of subsidiaries –18,020

Disposals (18,020) (75,281)

At the end of the year 78,689 112,520

Equity securities, at fair value

Listed in Hong Kong 1,442 636

Listed outside Hong Kong 75,031 91,769

76,473 92,405

Unlisted 2,216 20,115

78,689 112,520

Equity securities are denominated in the following currencies:

United States dollar 75,119 91,769

Renminbi 914 19,111

Hong Kong dollar 2,656 1,640

78,689 112,520

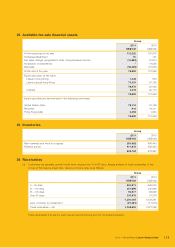

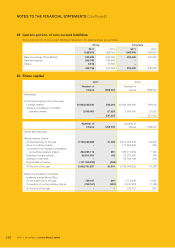

23 Inventories

Group

2011 2010

US$’000 US$’000

Raw materials and work-in-progress 391,892 490,443

Finished goods 411,810 388,444

803,702 878,887

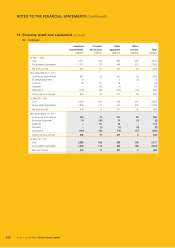

24 Receivables

(a) Customers are generally granted credit term ranging from 15 to 60 days. Ageing analysis of trade receivables of the

Group at the balance sheet date, based on invoice date, is as follows:

Group

2011 2010

US$’000 US$’000

0 – 30 days 941,811 665,535

31 – 60 days 251,698 242,946

61 – 90 days 92,817 68,526

Over 90 days 103,679 61,374

1,390,005 1,038,381

Less: provision for impairment (21,081) (17,319)

Trade receivables – net 1,368,924 1,021,062

Trade receivables that are not past due are fully performing and not considered impaired.