Lenovo 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited

86

NOTES TO THE FINANCIAL STATEMENTS (continued)

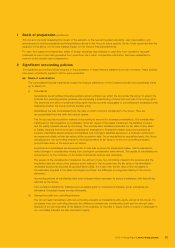

2 Significant accounting policies (continued)

(i) Impairment of financial assets

(i) Assets carried at amortized cost

The Group assesses at each balance sheet date whether there is objective evidence that a financial asset or a

group of financial assets is impaired. A financial asset or a group of financial assets is impaired and impairment

losses are incurred only if there is objective evidence of impairment as a result of one or more events that occurred

after the initial recognition of the asset (a ‘loss event’) and that loss event (or events) has an impact on the

estimated future cash flows of the financial asset or group of financial assets that can be reliably estimated.

The criteria that the Group uses to determine that there is objective evidence of an impairment loss include:

– significant financial difficulty of the issuer or obligor;

– a breach of contract, such as default or delinquency in interest or principal payments;

– it becomes probable that the borrower will enter bankruptcy or other financial reorganization; or

– observable data indicating that there is a measurable decrease in the estimated future cash flows from a

portfolio of financial assets since the initial recognition of those assets, although the decrease cannot yet be

identified with the individual financial assets in the portfolio, including:

(i) adverse changes in the payment status of borrowers in the portfolio;

(ii) national or local economic conditions that correlate with defaults on the assets in the portfolio.

The Group first assesses whether objective evidence of impairment exists.

For loans and receivables category, the amount of the loss is measured as the difference between the asset’s

carrying amount and the present value of estimated future cash flows (excluding future credit losses that have not

been incurred) discounted at the financial asset’s original effective interest rate. The asset’s carrying amount is

reduced and the amount of the loss is recognized in the income statement. If a loan or held-to-maturity investment

has a variable interest rate, the discount rate for measuring any impairment loss is the current effective interest rate

determined under the contract. As a practical expedient, the Group may measure impairment on the basis of an

instrument’s fair value using an observable market price.

If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related

objectively to an event occurring after the impairment was recognized (such as improvement in the debtor’s credit

rating), the reversal of the previously recognized impairment loss is recognized in the income statement.

(ii) Assets classified as available-for-sale

The Group assesses at each balance sheet date whether there is objective evidence that a financial asset or a

group of financial assets is impaired.

For debt securities classified as available-for-sale, the Group uses the criteria refer to (i) above. If, in a subsequent

period, the fair value of a debt instrument classified as available-for-sale increases and the increase can be

objectively related to an event occurring after the impairment loss was recognized in income statement, the

impairment loss is reversed through the income statement.

For equity investments classified as available-for-sale, a significant or prolonged decline in the fair value

of the security below its cost is also evidence that the assets are impaired. If any such evidence exists for

available-for-sale financial assets, the cumulative loss, measured as the difference between the acquisition cost

and the current fair value, less any impairment loss on that financial asset previously recognized in the income

statement, is removed from equity and recognized in the income statement. Impairment losses recognized in the

income statement on equity instruments are not reversed through the income statement.

(iii) Investments in subsidiaries

Impairment testing of the investments in subsidiaries is required upon receiving dividends from these investments

if the dividend exceeds the total comprehensive income of the subsidiary in the period the dividend is declared or

if the carrying amount of the investment in the separate financial statements exceeds the carrying amount in the

consolidated financial statements of the investee’s net assets including goodwill.