Lenovo 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010/11 Annual Report Lenovo Group Limited 107

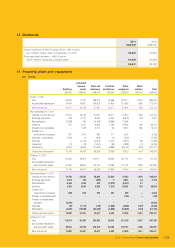

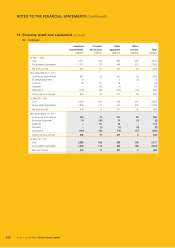

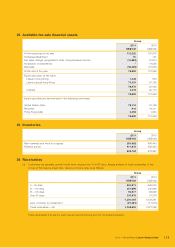

15 Prepaid lease payments

Group

2011 2010

US$’000 US$’000

At the beginning of the year 3,748 5,833

Exchange adjustment 164 8

Disposal of subsidiaries –(1,660)

Transfer from property, plant and equipment 5,866 –

Disposals –(308)

Amortization (96) (125)

At the end of the year 9,682 3,748

Prepaid lease payments represent the payments for land use rights held by the Group in the Chinese Mainland under medium

leases (less than 50 years but not less than 10 years).

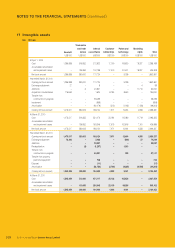

16 Construction-in-progress

Group Company

Buildings under

construction Internal use software Others Total Internal use software

2011 2010 2011 2010 2011 2010 2011 2010 2011 2010

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

At the beginning of the year 414 2,158 23,772 44,156 525 748 24,711 47,062 2,204 7,780

Exchange adjustment 31 2315 5(1) 1345 8(9) (6)

Reclassification (354) (1,253) (17) 246 255 1,007 (116) –––

Additions 1,335 196 66,752 37,125 10,444 2,658 78,531 39,979 4,868 2,206

Acquisition of subsidiaries –––145 –––145 ––

Transfer to property,

plant and equipment (688) (611) –(658) (2,135) (3,889) (2,823) (5,158) ––

Transfer to intangible assets ––(66,821) (56,499) (320) –(67,141) (56,499) (3,461) (7,776)

Disposals –––(748) (1,415) –(1,415) (748) ––

Disposals of subsidiaries –(78) –––––(78) ––

At the end of the year 738 414 24,001 23,772 7,353 525 32,092 24,711 3,602 2,204

No interest expenses were capitalized in construction-in-progress as at March 31, 2011 and 2010.