Kodak 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

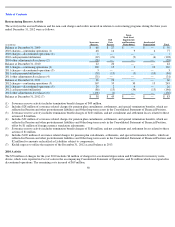

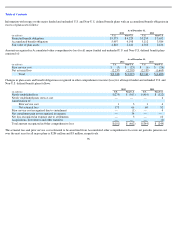

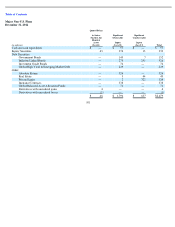

Operations. The severance and exit costs reserves require the outlay of cash, while long-lived asset impairments, accelerated depreciation and

inventory write-downs represent non-cash items.

The 2012 severance costs related to the elimination of approximately 3,225 positions, including approximately 1,775 manufacturing/service,

1,050 administrative, and 400 research and development positions. The geographic composition of these positions includes approximately 1,925

in the United States and Canada, and 1,300 throughout the rest of the world.

The charges of $271 million recorded in 2012 included $20 million applicable to the Graphics, Entertainment and Commercial Films Segment,

$93 million applicable to the Digital Printing and Enterprise Segment, $24 million applicable to the Personalized and Document Imaging

Segment, and $108 million that was applicable to manufacturing/service, research and development, and administrative functions, which are

shared across all segments. The remaining $26 million was applicable to discontinued operations.

As a result of these initiatives, severance payments will be paid during periods through 2013 since, in many instances, the employees whose

positions were eliminated can elect or are required to receive their payments over an extended period of time. In addition, certain exit costs, such

as long-term lease payments, will be paid over periods throughout 2013 and beyond.

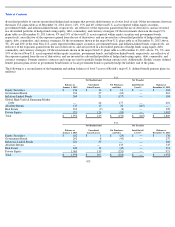

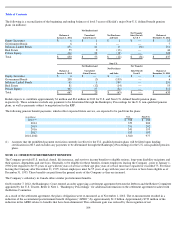

NOTE 20: RETIREMENT PLANS

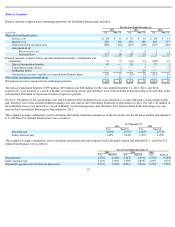

Substantially all U.S. employees are covered by a noncontributory defined benefit plan, the Kodak Retirement Income Plan (“KRIP”), which is

funded by the Company contributions to an irrevocable trust fund. The funding policy for KRIP is to contribute amounts sufficient to meet

minimum funding requirements as determined by employee benefit and tax laws plus any additional amounts the Company determines to be

appropriate. Generally, benefits are based on a formula recognizing length of service and final average earnings. Assets in the trust fund are held

for the sole benefit of participating employees and retirees. They are composed of corporate equity and debt securities, U.S. government

securities, partnership investments, interests in pooled funds, commodities, real estate, and various types of interest rate, foreign currency, debt,

and equity market financial instruments.

In March 1999, the Company amended KRIP to include a separate cash balance formula for all U.S. employees hired after February 1999 (the

“Cash Balance Plan”). All U.S. employees hired prior to that date were granted the option to choose the traditional KRIP plan or the Cash

Balance Plan. Written elections were made by employees in 1999, and were effective January 1, 2000. The Cash Balance Plan credits

employees’ hypothetical accounts with an amount equal to 4% of their pay, plus interest based on the 30-year treasury bond rate. In addition, for

employees participating in the Cash Balance Plan and the Company’s defined contribution plan, the Savings and Investment Plan (“SIP”), the

Company matches dollar-for-dollar on the first 1% contributed to SIP and $.50 for each dollar on the next 4% contributed. The Company

contributions to SIP were $8 million and $10 million for 2012 and 2011, respectively.

The Company also sponsors unfunded defined benefit plans for certain U.S. employees, primarily executives. The benefits of these plans are

obtained by applying KRIP provisions to all compensation, including amounts being deferred, and without regard to the legislated qualified plan

maximums, reduced by benefits under KRIP. Employees covered by the Cash Balance Plan also receive an additional benefit equal to 3% of

their annual pensionable earnings.

Many subsidiaries and branches operating outside the U.S. have defined benefit retirement plans covering substantially all employees.

Contributions by Kodak for these plans are typically deposited under government or other fiduciary-type arrangements. Retirement benefits are

generally based on contractual agreements that provide for benefit formulas using years of service and/or compensation prior to retirement. The

actuarial assumptions used for these plans reflect the diverse economic environments within the various countries in which Kodak operates.

The measurement date used to determine the pension obligation for all funded and unfunded U.S. and Non-U.S. defined benefit plans is

December 31.

94