Kodak 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

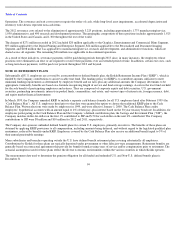

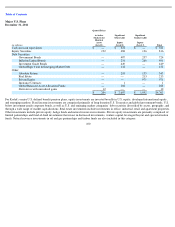

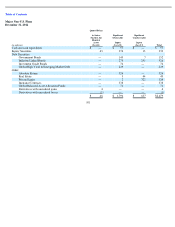

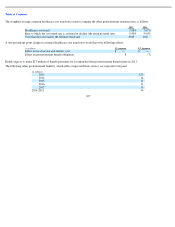

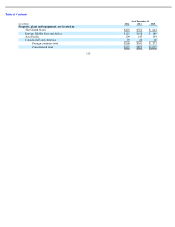

The following is a reconciliation of the beginning and ending balances of level 3 assets of Kodak’s major Non-U.S. defined benefit pension

plans (in millions):

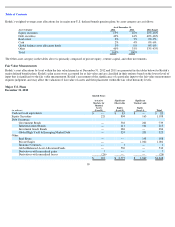

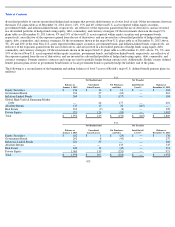

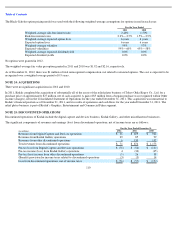

Kodak expects to contribute approximately $1 million and $34 million in 2013 for U.S. and Non-U.S. defined benefit pension plans,

respectively. These estimates exclude any payments to be determined through the Bankruptcy Proceedings for the U.S. non-qualified pension

plans, as well as payments subject to negotiation for the KPP.

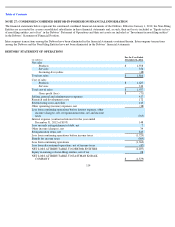

The following pension benefit payments, which reflect expected future service, are expected to be paid from the plans:

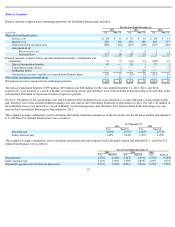

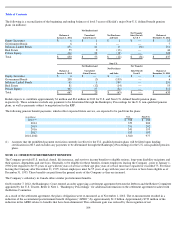

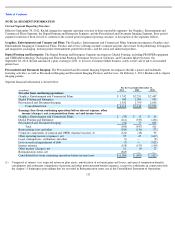

NOTE 21: OTHER POSTRETIREMENT BENEFITS

The Company provided U.S. medical, dental, life insurance, and survivor income benefits to eligible retirees, long-term disability recipients and

their spouses, dependents and survivors. Generally, to be eligible for these benefits, former employees leaving the Company , prior to January 1,

1996 were required to be 55 years of age with ten years of service or their age plus years of service must have equaled or exceeded 75. For those

leaving the Company after December 31, 1995, former employees must be 55 years of age with ten years of service or have been eligible as of

December 31, 1995. These benefits are paid from the general assets of the Company as they are incurred.

The Company’s subsidiary in Canada offers similar postretirement benefits.

On November 7, 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the Retiree Committee

appointed by the U.S. Trustee. Refer to Note 1, “Bankruptcy Proceedings” for additional information on the settlement agreement reached with

the Retiree Committee.

As a result of the settlement agreement, the plan’s obligations were re-measured as of November 1, 2012. The re-measurement resulted in a

reduction of the accumulated postretirement benefit obligation (“APBO”) by approximately $1.2 billion. Approximately $739 million of the

reduction in the APBO relates to benefits that have been eliminated. This settlement gain was reduced by the recognition of net

104

Balance at

January 1, 2012

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2012

Equity Securities

$

6

$

1

$

6

$

—

$

13

Government Bonds

6

1

—

—

7

Inflation

-

Linked Bonds

251

21

13

(34

)

251

Real Estate

55

2

(13

)

—

44

Private Equity

312

28

(18

)

—

322

Total

$

630

$

53

$

(12

)

$

(34

)

$

637

Non

-

U.S.

Balance at

January 1, 2011

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2011

Equity Securities

$

6

$

—

$

—

$

—

$

6

Government Bonds

208

(3

)

(199

)

—

6

Inflation

-

Linked Bonds

65

6

180

—

251

Real Estate

81

(12

)

(14

)

—

55

Private Equity

307

37

(32

)

—

312

Total

$

667

$

28

$

(65

)

$

—

$

630

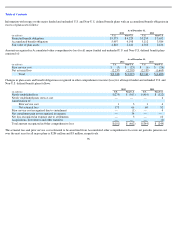

(in millions)

U.S.

Non

-

U.S.

2013

$

928

$

204

2014

359

200

2015

351

202

2016

341

195

2017

333

193

2018

-

2022

1,560

977

(1) Assumes that the prohibited payment restriction currently in effect for the U.S. qualified pension plans will be lifted upon funding

certification in 2013 and excludes any payments to be determined through the Bankruptcy Proceedings for the U.S. non-qualified pension

plans.

(1)