Kodak 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

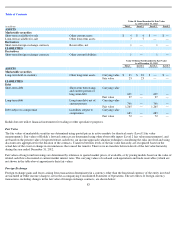

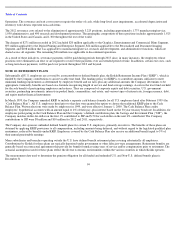

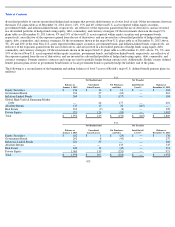

including $48 million of severance costs, $14 million of exit costs, and $7 million of long-lived asset impairments, were reported as

Restructuring costs and other in the accompanying Consolidated Statement of Operations. The severance and exit costs reserves require the

outlay of cash, while long-lived asset impairments, accelerated depreciation and inventory write-downs represent non-cash items.

The 2010 severance costs related to the elimination of approximately 800 positions, including approximately 550 manufacturing/service, 225

administrative and 25 research and development positions. The geographic composition of these positions includes approximately 475 in the

United States and Canada, and 325 throughout the rest of the world.

The charges of $78 million recorded in 2010 included $9 million applicable to the Graphics, Entertainment and Commercial Films Segment, $1

million applicable to the Digital Printing and Enterprise Segment, $7 million applicable to the Personalized and Document Imaging Segment,

and $60 million that was applicable to manufacturing/service, research and development, and administrative functions, which are shared across

all segments. The remaining $1 million was applicable to discontinued operations.

As a result of these initiatives, severance payments will be paid during periods through 2011 since, in many instances, the employees whose

positions were eliminated can elect or are required to receive their payments over an extended period of time. In addition, certain exit costs, such

as long-term lease payments, will be paid over periods throughout 2011 and beyond.

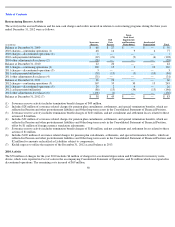

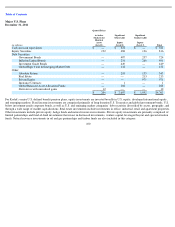

2011 Activity

The $133 million of charges for the year 2011 includes $10 million of charges for accelerated depreciation and $2 million for inventory write-

downs, which were reported in Cost of sales in the accompanying Consolidated Statement of Operations, and $3 million which was reported in

discontinued operations. The remaining costs incurred of $118 million, including $102 million of severance costs, $15 million of exit costs, and

$1 million of long-lived asset impairments, were reported as Restructuring costs and other in the accompanying Consolidated Statement of

Operations. The severance and exit costs reserves require the outlay of cash, while long-lived asset impairments, accelerated depreciation and

inventory write-downs represent non-cash items.

The 2011 severance costs related to the elimination of approximately 1,225 positions, including approximately 575 manufacturing/service, 550

administrative and 100 research and development positions. The geographic composition of these positions includes approximately 725 in the

United States and Canada, and 500 throughout the rest of the world.

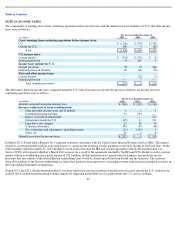

The charges of $133 million recorded in 2011 included $23 million applicable to the Graphics, Entertainment and Commercial Films Segment,

$6 million applicable to the Digital Printing and Enterprise Segment, $6 million applicable to the Personalized and Document Imaging Segment,

and $95 million that was applicable to manufacturing/service, research and development, and administrative functions, which are shared across

all segments. The remaining $3 million was applicable to discontinued operations.

As a result of these initiatives, severance payments will be paid during periods through 2012 since, in many instances, the employees whose

positions were eliminated can elect or are required to receive their payments over an extended period of time. In addition, certain exit costs, such

as long-term lease payments, will be paid over periods throughout 2012 and beyond.

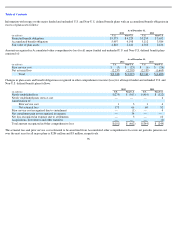

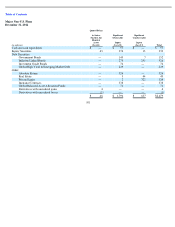

2012 Activity

Restructuring actions taken in 2012 were initiated to reduce Kodak’s cost structure as part of its commitment to drive sustainable profitability.

Actions included the winding down of sales of consumer inkjet printers, the digital capture and devices business exit, traditional product

manufacturing capacity reductions in the U.S. and Mexico, workforce reductions triggered by the Kodak Gallery wind-down, consolidation of

thermal media manufacturing in the U.S. and various targeted reductions in research and development, sales, service, and other administrative

functions.

The $271 million of charges for the year 2012 includes $13 million of charges for accelerated depreciation and $4 million for inventory write-

downs, which were reported in Cost of sales in the accompanying Consolidated Statement of Operations, and $26 million which was reported as

discontinued operations. The remaining costs incurred of $228 million, including $167 million of severance costs, $35 million of exit costs, and

$26 million of long-lived asset impairments, were reported as Restructuring costs and other in the accompanying Consolidated Statement of

93