Kodak 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the

reader understand the results of operations and financial condition of Kodak for the three years ended December 31, 2012, 2011 and 2010. All

references to Notes relate to Notes to the Financial Statements in Item 8. “Financial Statements and Supplementary Data.”

OVERVIEW

The Bankruptcy Filing is intended to permit Kodak to reorganize and increase liquidity in the U.S., monetize non-strategic intellectual property

and businesses, fairly resolve legacy liabilities, and focus on the most valuable business lines to enable sustainable profitability. The Debtors’

goal is to develop and implement a reorganization plan that meets the standards for confirmation under the Bankruptcy Code.

The Debtors have made progress toward these objectives, including the following:

Kodak is focusing its reorganization plan on its commercial imaging businesses; Graphics, Entertainment and Commercial Films and Digital

Printing and Enterprise Services. In order to focus on its most valuable business lines, Kodak exited its digital capture and devices business,

including digital cameras, pocket video cameras, and digital picture frames and sold certain assets of its Kodak Gallery business. Additionally,

Kodak has announced its decision to initiate sale processes for its Personalized Imaging and Document Imaging businesses. Kodak has also

announced that it is focusing its Consumer Inkjet business solely on the sale of ink to its installed printer base.

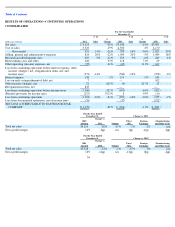

Revenue and profitability for the year ended December 31, 2012 declined from the prior year primarily due to volume declines across all

segments. Kodak has been working to mitigate the effects on profitability of the lower sales volumes by improving gross profit percentages and

reducing costs, including by leveraging the bankruptcy process to negotiate more favorable supplier and customer contract terms. The costs of

the bankruptcy proceedings have also significantly impacted profitability in 2012.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The accompanying consolidated financial statements and notes to consolidated financial statements contain information that is pertinent to

management’s discussion and analysis of the financial condition and results of operations. The preparation of financial statements in conformity

with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that

affect the reported amounts of assets, liabilities, revenue and expenses, and the related disclosure of contingent assets and liabilities.

Kodak believes that the critical accounting policies and estimates discussed below involve the most complex management judgments due to the

sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and expense amounts. Specific risks

associated with these critical accounting policies are discussed throughout this MD&A, where such policies affect Kodak’s reported and

expected financial results. For a detailed discussion of the application of these and other accounting policies, refer to the Notes to Financial

Statements in Item 8.

The consolidated financial statements and related notes have been prepared assuming that Kodak will continue as a going concern, even though

the Bankruptcy Filing raises substantial doubt about Kodak’s ability to continue as a going concern. The

25

•

In November 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the retiree

committee appointed by the U.S. Trustee related to its U.S. postretirement benefit plans. Under the settlement agreement, the Debtors

will no longer provide retiree medical, dental, life insurance, and survivor income benefits to current and future retirees after

December 31, 2012 (other than COBRA continuation coverage of medical and/or dental benefits available to active employees or

conversion coverage as required by the plans or applicable law).

•

In February 2013, Kodak received approximately $530 million related to the sale and licensing of certain of its intellectual property

assets and repaid approximately $419 million of the outstanding term loan under the DIP Credit Agreement.

•

On February 28, 2013, the Company and members of the Steering Committee of the Second Lien Noteholders agreed to structure and

arrange a junior secured priming super-priority debtor-in-possession term loan facility (the “Junior DIP Facility”) in an aggregate

amount of up to $848 million. The Junior DIP Facility would allow for a conversion of up to $654 million of the loans, upon

emergence from chapter 11, into permanent exit financing, subject to certain conditions. Closing of the agreement is subject to

certain conditions, including consent by the Asset-Based Loan (“ABL”) lenders under the existing DIP Credit Agreement, and

completion by April 5, 2013.