Kodak 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

would be necessary to exclude the assets of the Document Imaging and Personalized Imaging businesses from the disposition. Closing of the

Junior DIP Facility is subject to certain conditions, including approval by the Bankruptcy Court of the Junior DIP Facility, repayment in full of

the term loans under the DIP Credit Agreement, and consent of the ABL lenders under the existing DIP Credit Agreement. On March 1, 2013,

the Debtors filed a motion with the Bankruptcy Court seeking approval of the Junior DIP Facility. The Bankruptcy Court approved the Debtors’

motion on March 8, 2013. The agreement with the Commitment Parties expires on April 5, 2013.

Refer to Note 11, “Short-Term Borrowings and Long-Term Debt” for additional information on the Junior DIP Facility.

PRE

-PETITION CLAIMS

On April 18, 2012, as amended on May 16, 2012 and February 1, 2013, the Debtors filed schedules of assets and liabilities and statements of

financial affairs with the Bankruptcy Court. On May 10, 2012, the Bankruptcy Court entered an order establishing July 17, 2012 as the bar date

for potential creditors to file proofs of claims and established the required procedures with respect to filing such claims. A bar date is the date by

which pre-petition claims against the Debtors must be filed if the claimants wish to receive any distribution in the chapter 11 proceedings.

As of February 22, 2013, the Debtors have received approximately 6,100 proofs of claim, a portion of which assert, in part or in whole,

unliquidated claims. In the aggregate, total liquidated proofs of claim of approximately $21.4 billion have been filed against the Debtors. New

and amended claims may be filed in the future, including claims amended to assign values to claims originally filed with no designated value.

The Debtors are now in the process of reconciling such claims to the amounts listed by the Debtors in their schedule of assets and liabilities (as

amended). Differences in liability amounts estimated by the Debtors and claims filed by creditors will be investigated and resolved, including

through the filing of objections with the Bankruptcy Court, where appropriate. Approximately 1,100 claims totaling approximately $1.1 billion

have been expunged or withdrawn and the Debtors have filed additional claim objections with the Bankruptcy Court for approximately 200

claims totaling approximately $30 million in additional reductions. The Debtors may continue to ask the Bankruptcy Court to disallow claims

that the Debtors believe are duplicative, have been later amended or superseded, are without merit, are overstated or should be disallowed for

other reasons. In addition, as a result of this process, the Debtors may identify additional liabilities that will need to be recorded or reclassified to

liabilities subject to compromise. In light of the substantial number of claims filed, the claims resolution process may take considerable time to

complete. The resolution of such claims could result in material adjustments to Kodak’s financial statements. The determination of how

liabilities will ultimately be treated cannot be made until the Bankruptcy Court approves a plan of reorganization. Accordingly, the ultimate

amount or treatment of such liabilities is not determinable at this time.

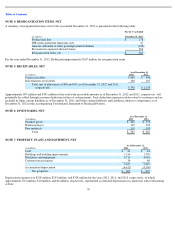

FINANCIAL REPORTING IN REORGANIZATION

Expenses, gains and losses directly associated with reorganization proceedings are reported as Reorganization items, net in the accompanying

Consolidated Statement of Operations. In addition, liabilities subject to compromise in the chapter 11 proceedings are distinguished from

liabilities of Non-Filing Entities, fully secured liabilities not expected to be compromised and from post-petition liabilities in the accompanying

Consolidated Statement of Financial Position as of December 31, 2012. Where there is uncertainty about whether a secured claim will be paid or

impaired under the chapter 11 proceedings, Kodak has classified the entire amount of the claim as a liability subject to compromise. The amount

of liabilities subject to compromise represents Kodak’s estimate, where an estimate is determinable, of known or potential pre-petition claims to

be addressed in connection with the bankruptcy proceedings. Such liabilities are reported at Kodak’s current estimate, where an estimate is

determinable, of the allowed claim amounts, even though the claims may be settled for lesser amounts. These claims remain subject to future

adjustments, which may result from: negotiations; actions of the Bankruptcy Court; disputed claims; rejection of contracts and unexpired leases;

the determination as to the value of any collateral securing claims; proofs of claims; or other events.

Effective as of January 19, 2012, Kodak ceased recording interest expense on outstanding pre-petition debt classified as liabilities subject to

compromise. Contractual interest expense represents amounts due under the contractual terms of outstanding debt, including debt subject to

compromise. For the period from January 19, 2012 through December 31, 2012 contractual interest expense related to liabilities subject to

compromise of approximately $45 million has not been recorded, as it is not expected to be an allowed claim under the chapter 11 case.

SECTION 363 ASSET SALES

On May 2, 2012, Kodak sold certain assets of Kodak Gallery on-line photo services business for $23.8 million to Shutterfly, Inc. Approximately

75% of the net proceeds from the sale were used to repay term debt under the DIP Credit Agreement.

On August 23, 2012, Kodak announced the decision to initiate sale processes for its Personalized Imaging and Document Imaging businesses.

The Personalized Imaging business consists of retail systems solutions, paper & output systems, and event imaging solutions. The Document

Imaging business consists of scanners, as well as capture software, and services for enterprise customers.

61