Kodak 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

On February 1, 2013, Kodak entered into a series of agreements related to the monetization of certain of its intellectual property assets, including

the sale of its digital imaging patents. Under these agreements, Kodak received approximately $530 million, a portion of which was paid by

twelve licensees that received a license to the digital imaging patent portfolio and other patents owned by Kodak. Another portion was paid by

Intellectual Ventures Fund 83 LLC (“Intellectual Ventures”) and Apple, Inc., each of which acquired a portion of the digital imaging patent

portfolio, subject to the licenses granted to the twelve new licensees, and previously existing licenses. In addition, Kodak retained a license to the

digital imaging patents for its own use. In connection with this transaction, the Company entered into a separate agreement with FUJIFILM

Corporation (“Fuji”) whereby, among other things, Fuji granted Kodak the right to sub-license certain Fuji Patents to businesses Kodak intends

to sell as part of the Company’s emergence efforts. The Debtors also agreed to allow Fuji a general unsecured pre-petition claim against the

Debtors in the amount of $70 million.

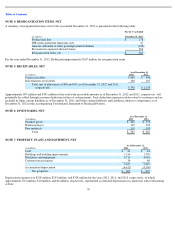

OTHER POSTEMPLOYMENT BENEFITS

On November 7, 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the Official

Committee of Retired Employees appointed by the U.S. Trustee under the chapter 11 proceedings (the “Retiree Committee”). The Retiree

Committee was appointed to negotiate with the Debtors on behalf of eligible retirees, long-term disability recipients, and their spouses,

dependents and survivors (“Retirees”), concerning the future of U.S. retiree medical, dental, life insurance, and survivor income benefits.

Under the settlement agreement, the Debtors will no longer provide retiree medical, dental, life insurance and survivor income benefits to current

and future Retirees after December 31, 2012 (other than COBRA continuation coverage of medical and/or dental benefits or conversion

coverage as required by the plans or applicable law), and the Retiree Committee will set up a trust or account from which some limited benefits

for some retirees may be provided after December 31, 2012. The trust or account will be funded by the following contributions from the

Debtors: $7.5 million in cash paid by the Company in the fourth quarter of 2012, an administrative claim against the Debtors in the amount of

$15 million, and a general unsecured claim against the Debtors in the amount of $635 million. As part of the settlement, all other claims arising

from or based on the termination or modification of retiree medical, dental, life insurance and survivor income benefits will be deemed settled

and disallowed.

The $650 million in claims against the Debtors and the $7.5 million cash payment are reflected in Reorganization items, net in the accompanying

Consolidated Statement of Operations.

EASTMAN KODAK COMPANY GUARANTEE

Eastman Kodak Company (“EKC”) has previously issued (pre-petition) a guarantee to Kodak Limited (the “Subsidiary”) and the Trustee

(“Trustee”) of the Kodak Pension Plan (the “KPP”) in the United Kingdom. Under that arrangement, EKC guaranteed to the Subsidiary and the

Trustee the ability of the Subsidiary, only to the extent it becomes necessary to do so, to (1) make contributions to the KPP to ensure sufficient

assets exist to make plan benefit payments, as they become due, if the KPP otherwise would not have sufficient assets and (2) make

contributions to the KPP such that it will achieve fully funded status by the funding valuation for the period ending December 31, 2022.

The Subsidiary agreed to make certain contributions to the KPP as determined by a funding plan agreed to by the Trustee. Under the terms of

this agreement, the Subsidiary is obligated to pay a minimum amount of $50 million to the KPP in each of the years 2011 through 2014, and a

minimum amount of $90 million to the KPP in each of the years 2015 through 2022. The Subsidiary has not paid the annual contribution due for

2012 and payment of this amount may be demanded at any time. Future funding beyond 2022 would be required if the KPP is still not fully

funded as determined by the funding valuation for the period ending December 31, 2022. These payment amounts for the years 2015 through

2022 could be lower, and the payment amounts for all years noted could be higher by up to $5 million each year, based on the exchange rate

between the U.S. dollar and British pound. These minimum amounts do not include potential contributions related to tax benefits received by the

Subsidiary.

The underfunded position of the KPP of approximately $1.5 billion (calculated in accordance with U.S. GAAP) is included in Pension and other

postretirement liabilities presented in the Consolidated Statement of Financial Position as of December 31, 2012. The underfunded obligation

relates to a non-

debtor entity. The Trustee has asserted an unsecured claim of approximately $2.8 billion under the guarantee. The Subsidiary has

also asserted an unsecured claim under the guarantee for an unliquidated amount. The ultimate treatment of the Trustee’s and the Subsidiary’s

claims is not determinable at this time.

EKC has proposed that the Subsidiary’s 2012 and future contributions be considered part of the overall resolution of the claims of the Trustee

and Subsidiary.

GOING CONCERN

Kodak incurred a net loss for the years ended 2012, 2011 and 2010 and had a shareholders’ deficit as of December 31, 2012 and 2011. To

improve Kodak’s performance and address competitive challenges, Kodak is developing a strategic plan for the ongoing operation of

62