Kodak 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

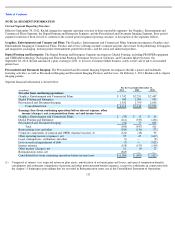

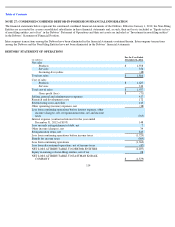

Corporate components of pension and OPEB include interest cost, expected return on plan assets, amortization of actuarial gains and losses, and

special termination benefits, curtailments and settlement components of pension and other postretirement benefit expenses, except for

settlements in connection with the chapter 11 bankruptcy proceedings that are recorded in Reorganization items, net in the Consolidated

Statement of Operations.

Changes in Estimates Recorded During the Fourth Quarter Ended December 31, 2012

During the fourth quarter ended December 31, 2012, Kodak recorded an increase of expense of approximately $35 million, net of tax, related to

changes in estimates with respect to certain of its employee benefit and compensation accruals. These changes in estimates negatively impacted

results for the quarter by $.13 per share.

119

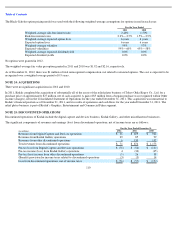

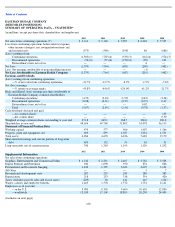

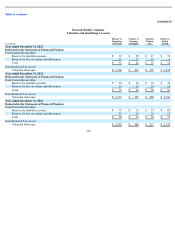

(1) Includes pre-tax restructuring charges of $81 million ($1 million included in Cost of sales and $80 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $78 million; corporate components of pension and OPEB costs of

$30 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $26 million; and

$88 million of Reorganization items, net.

(2) Includes pre-tax restructuring charges of $11 million ($2 million included in Cost of sales and $9 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $10 million; corporate components of pension and OPEB costs of

$35 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $32 million; and

$160 million of Reorganization items, net.

(3) Includes pre-tax restructuring charges of $126 million ($9 million included in Cost of sales and $117 million included in Restructuring

costs and other), which decreased net earnings from continuing operations by $119 million; corporate components of pension and OPEB

costs of $35 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $28

million; and $56 million of Reorganization items, net.

(4) Includes pre-tax restructuring charges of $27 million ($5 million included in Cost of sales and $22 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $30 million; corporate components of pension and OPEB costs of

$23 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $18 million; and

$539 million, of Reorganization items, net.

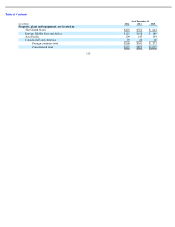

(5) Includes pre-tax restructuring charges of $33 million ($2 million included in Cost of sales and $31 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $32 million; and corporate components of pension and OPEB

costs of $8 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $6 million.

(6) Includes pre-tax restructuring charges of $35 million ($7 million included in Cost of sales and $28 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $32 million; and corporate components of pension and OPEB

costs of $4 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $2 million.

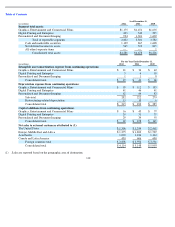

(7) Includes pre-tax restructuring charges of $18 million ($1 million included in Cost of sales and $17 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $18 million; corporate components of pension and OPEB costs of

$13 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $9 million; and a

pre-tax impairment charge of $8 million (included in Other operating expenses (income), net), which decreased net earnings from

continuing operations by $8 million.

(8) Includes pre-tax restructuring charges of $44 million ($2 million included in Cost of sales and $42 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $42 million; corporate components of pension and OPEB costs of

$4 million (included in Cost of sales, SG&A, and R&D), which decreased net earnings from continuing operations by $1 million.

(9) Refer to Note 25, “Discontinued Operations,” in the Notes to Financial Statements for a discussion regarding loss from discontinued

operations.