Kodak 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

that consent of the Required Lead Lenders would be necessary to exclude the assets of the Document Imaging and Personalized Imaging

businesses from the disposition; the resolution of all obligations owing in respect of the KPP on terms reasonably satisfactory to the Required

Lead Lenders (as defined in the agreement with the Commitment Parties); and there shall have been an additional prepayment of loans in an

amount equal to 75% of U.S. Liquidity (as defined in the agreement with the Commitment Parties) above $200 million.

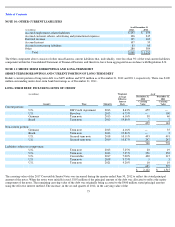

SECOND AMENDED AND RESTATED CREDIT AGREEMENT

On April 26, 2011, the Company and its subsidiary, Kodak Canada, Inc., together with the Company’s U.S. subsidiaries as guarantors entered

into a Second Amended and Restated Credit Agreement (“Second Amended Credit Agreement”), with the named lenders and Bank of America,

N.A. as administrative agent, in order to amend and extend its Amended and Restated Credit Agreement dated as of March 31, 2009, as amended

(“Amended Credit Agreement”).

On January 20, 2012, the Company repaid all obligations and terminated all commitments under the Second Amended Credit Agreement in

connection with entering into and drawing funds from the DIP Credit Agreement. The repayment resulted in a loss on early extinguishment of

debt of $7 million.

SENIOR SECURED NOTES DUE 2019

On March 15, 2011, the Company issued $250 million of aggregate principal amount of 10.625% senior secured notes due March 15, 2019

(2019 Senior Secured Notes). Terms of the notes require interest at an annual rate of 10.625% of the principal amount at issuance, payable semi-

annually in arrears on March 15 and September 15 of each year, beginning on September 15, 2011.

Upon issuance of the 2019 Senior Secured Notes, the Company received proceeds of approximately $247 million ($250 million aggregate

principal less $3 million stated discount). The proceeds were used to repurchase $50 million of the 7.25% senior notes due 2013 with the

remaining amount being used for other general corporate purposes.

In connection with the issuance of the 2019 Senior Secured Notes, the Company and the subsidiary guarantors entered into an indenture, dated as

of March 15, 2011, with Bank of New York Mellon as trustee and second lien collateral agent (Indenture). Wilmington Trust, National

Association replaced and succeeded Bank of New York Mellon as Trustee and second-lien collateral agent on January 26, 2012.

The 2019 Senior Secured Notes are fully and unconditionally guaranteed (Guarantees) on a senior secured basis by each of the Company’s

existing and future direct or indirect 100% owned domestic subsidiaries, subject to certain exceptions (Subsidiary Guarantors). The 2019 Senior

Secured Notes and Guarantees are secured by second-priority liens, subject to permitted liens, on substantially all of the Company’s domestic

assets and substantially all of the domestic assets of the Subsidiary Guarantors pursuant to a supplement, dated March 15, 2011, to the security

agreement, dated March 5, 2010, entered into with Bank of New York Mellon as second lien collateral agent. The carrying value of the assets

pledged as collateral at December 31, 2012 was approximately $1 billion.

The 2019 Senior Secured Notes are the Company’s senior secured obligations and rank senior in right of payment to any future subordinated

indebtedness; rank equally in right of payment with all of the Company’s existing and future senior indebtedness; are effectively senior in right

of payment to the Company’s existing and future unsecured indebtedness, are effectively subordinated in right of payment to indebtedness under

the Company’s DIP Credit Agreement to the extent of the collateral securing such indebtedness on a first- (or, upon closing of the Junior DIP

Facility, second-) priority basis and will be effectively subordinated in right of payment to indebtedness under the Junior DIP Facility to the

extent of the collateral that will secure such indebtedness on a first- or second-

priority basis; and effectively are subordinated in right of payment

to all existing and future indebtedness and other liabilities of the Company’s non-guarantor subsidiaries.

The Bankruptcy Filing constituted an event of default under the 2019 Senior Secured Notes. The creditors are, however, stayed from taking any

action as a result of the default under Section 362 of the Bankruptcy Code. See Junior DIP Facility and Second Lien Note Holders Agreement for

discussion of the potential conversion of up to $375 million of Second Lien Notes into Junior Loans under the Junior DIP Facility and an

adequate protection agreement.

SENIOR SECURED NOTES DUE 2018

On March 5, 2010, the Company issued $500 million of aggregate principal amount of 9.75% senior secured notes due March 1, 2018 (the

“2018 Senior Secured Notes”). Terms of the Notes require interest at an annual rate of 9.75% of the principal amount at issuance, payable semi-

annually in arrears on March 1 and September 1 of each year, beginning on September 1, 2010.

Upon issuance of the 2018 Senior Secured Notes, the Company received net proceeds of approximately $490 million ($500 million aggregate

principal less $10 million stated discount). The proceeds were used to repurchase all of the Senior Secured Notes due 2017 and to fund the tender

of $200 million of the 7.25% Senior Notes due 2013.

76