Kodak 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

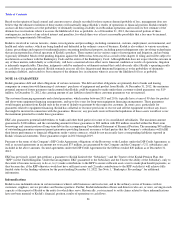

In connection with the 2018 Senior Secured Notes, the Company and the subsidiary guarantors entered into an indenture, dated as of March 5,

2010, with Bank of New York Mellon as trustee and collateral agent (the “Indenture”). Wilmington Trust, National Association replaced and

succeeded Bank of New York Mellon as Trustee and second-lien collateral agent on January 26, 2012.

The 2018 Senior Secured Notes are fully and unconditionally guaranteed (the “guarantees”) on a senior secured basis by each of the Company’s

existing and future direct or indirect 100% owned domestic subsidiaries, subject to certain exceptions (the “Subsidiary Guarantors”). The 2018

Senior Secured Notes and guarantees are secured by second-priority liens, subject to permitted liens, on substantially all of the Company’s

domestic assets and substantially all of the domestic assets of the Subsidiary Guarantors pursuant to a security agreement entered into with Bank

of New York Mellon as second lien collateral agent on March 5, 2010. Wilmington Trust, National Association replaced and succeeded Bank of

New York Mellon as Trustee and second

-lien collateral agent on January XX, 2012. The carrying value of the assets pledged as collateral at

December 31, 2012 was approximately $1 billion.

The 2018 Senior Secured Notes are the Company’s senior secured obligations and rank senior in right of payment to any future subordinated

indebtedness; rank equally in right of payment with all of the Company’s existing and future senior indebtedness; are effectively senior in right

of payment to the Company’s existing and future unsecured indebtedness, are effectively subordinated in right of payment to indebtedness under

the Company’s DIP Credit Agreement to the extent of the collateral securing such indebtedness on a first- (or, upon closing of the Junior DIP

Facility, second-) priority basis and will be effectively subordinated in right of payment to indebtedness under the Junior DIP Facility to the

extent of the collateral that will secure such indebtedness on a first- or second-

priority basis; and effectively are subordinated in right of payment

to all existing and future indebtedness and other liabilities of the Company’s non-guarantor subsidiaries.

The Bankruptcy Filing constituted an event of default under the 2018 Senior Secured Notes. The creditors are, however, stayed from taking any

action as a result of the default under Section 362 of the Bankruptcy Code. See Junior DIP Facility and Second Lien Note Holders Agreement for

discussion of the potential conversion of up to $375 million of 2018 Second Lien Notes into Junior Loans under the Junior DIP Facility and an

adequate protection agreement.

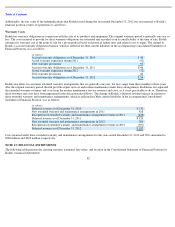

SECOND LIEN NOTE HOLDERS AGREEMENT

On February 14, 2012, the Company reached an adequate protection agreement with a group representing at least 50.1% of the Second Lien Note

Holders which was reflected in the final DIP Credit Agreement order (the “Final DIP Order”). The Company agreed, among other things, to

provide all Second Lien Note Holders with a portion of the proceeds received from certain sales and settlements in respect of the Company’s

digital imaging patent portfolio subject to the following waterfall and the Company’s right to retain a percentage of certain proceeds under the

DIP Credit Agreement: first, to repay any outstanding obligations under the DIP Credit Agreement, including cash collateralizing letters of credit

(unless certain parties otherwise agree); second, to pay 50% of accrued second lien interest at the non-default rate; third, the Company retains

$250 million; fourth, to repay the remaining accrued and unpaid second lien interest at the non-default rate; fifth, any remaining proceeds after

conditions one through four up to $2,250 million to be split 60% to the Company and 40% to repay outstanding second lien debt at par; and

sixth, the Company agreed that any proceeds above $2,250 million will be split 50% to the Company and 50% to Second Lien Note Holders

until second lien debt is fully paid. The Company also agreed to pay current interest to Second Lien Note Holders upon the receipt of $250

million noted above. Subject to the satisfaction of certain conditions, the Company also agreed to pay reasonable fees of certain advisors to the

Second Lien Note Holders. On February 1, 2013, the Company received approximately $530 million in net proceeds from the sale and other

settlements related to the digital imaging patent portfolio and therefore no payments were made to the Second Lien Note Holders.

In connection with the Junior DIP Facility, holders of the Company’s Second Lien Notes would be entitled to receive accrued non-default

interest on the Second Lien Notes. Second Lien Notes outstanding after the Bankruptcy Court approval of the Junior DIP Facility, would be

entitled to receive as additional adequate protection (i) replacement liens on Junior DIP collateral that are junior to the liens securing the existing

DIP Credit Agreement and the Junior DIP Facility, (ii) guarantees from all entities that guarantee the existing DIP Credit Agreement and the

Junior DIP Facility that are subordinate to the guarantee in respect of the existing DIP Credit Agreement and the Junior DIP Facility, and

(iii) administrative claims as provided for in section 507(b) of the Bankruptcy Code, junior to the super-priority administrative expense claims

that would be granted to the lenders under the Junior DIP Facility and DIP Credit Agreement (in each case of clauses (i), (ii) and (iii), to the

extent of any diminution of the value of the applicable pre-petition collateral from and after January 19, 2012). The Second Lien Notes are

considered fully secured and have not been reported as liabilities subject to compromise.

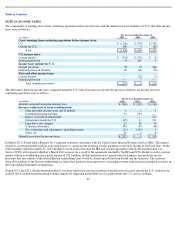

2017 CONVERTIBLE SENIOR NOTES

On September 23, 2009, the Company issued $400 million of aggregate principal amount of 7% convertible senior notes due April 1, 2017 (the

“2017 Convertible Notes”). Terms of the Notes require interest at an annual rate of 7% of the principal amount at issuance, payable semi-

annually in arrears on April 1 and October 1 of each year, beginning on April 1, 2010.

The 2017 Convertible Notes are convertible at an initial conversion rate of 134.9528 shares of the Company’s common stock per $1,000

principal amount of convertible notes (representing an initial conversion price of approximately $7.41 per share of common stock) subject to

adjustment in certain circumstances. Holders may surrender their 2017 Convertible Notes for conversion at any time prior to

77