Kodak 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

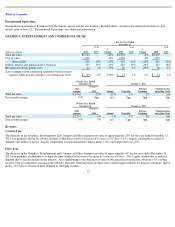

Kodak announced in August 2012, its decision to initiate sale processes for its Personalized Imaging and Document Imaging businesses. The

cash flows related to these reporting units could significantly change and materially impact the fair value of these reporting units depending on

the sale process or other factors. Total goodwill assigned to the Personalized and Document Imaging businesses approximated $147 million as of

December 31, 2012.

A 20 percent change in estimated future cash flows or a 10 percentage point change in discount rate in the remaining reporting units would not

have caused material goodwill impairment charges to be recognized by Kodak as of September 30, 2012. Additional impairment of goodwill

could occur in the future if market or interest rate environments deteriorate, expected future cash flows decrease or if reporting unit carrying

values change materially compared with changes in respective fair values.

Kodak’s long-lived assets other than goodwill are evaluated for impairment whenever events or changes in circumstances indicate the carrying

value may not be recoverable.

When evaluating long-lived assets for impairment, Kodak compares the carrying value of an asset group to its estimated undiscounted future

cash flows. An impairment is indicated if the estimated future cash flows are less than the carrying value of the asset group. The impairment is

the excess of the carrying value over the fair value of the long-lived asset group.

In 2005, Kodak shortened the useful lives of certain production machinery and equipment in the traditional film and paper businesses as a result

of the anticipated acceleration of the decline in those businesses at that time. The result of that change was that the related production machinery

and equipment was scheduled to be fully depreciated by mid-2010 for the traditional film and paper businesses. In 2010, and again in 2011, with

the benefit of additional experience in the secular decline in these product groups, Kodak assessed that overall film and paper demand had

declined but at a slower rate than anticipated in previous analyses. Therefore, with respect to production machinery and equipment and buildings

in film and paper manufacturing locations that were expected to continue production beyond the previously estimated useful life, Kodak

extended the useful lives.

Kodak depreciates the cost of property, plant, and equipment over its expected useful life in such a way as to allocate it as equitably as possible

to the periods during which services are obtained from their use, which aims to distribute the cost over the estimated useful life of the unit in a

systematic and rational manner. An estimate of useful life not only considers the economic life of the asset, but also the remaining life of the

asset to the entity. Because the film and paper businesses are experiencing industry related volume declines, changes in the estimated useful lives

of production equipment for those businesses have been related to estimated industry demand, in addition to production capacity of the particular

property.

Income Taxes

Kodak recognizes deferred tax liabilities and assets for the expected future tax consequences of operating losses, credit carry-forwards and

temporary differences between the carrying amounts and tax basis of Kodak’s assets and liabilities. Kodak records a valuation allowance to

reduce its net deferred tax assets to the amount that is more likely than not to be realized. Kodak has considered forecasted earnings, future

taxable income, the geographical mix of earnings in the jurisdictions in which Kodak operates and prudent and feasible tax planning strategies in

determining the need for these valuation allowances. As of December 31, 2012, Kodak has net deferred tax assets before valuation allowances of

approximately $3.4 billion and a valuation allowance related to those net deferred tax assets of approximately $2.8 billion, resulting in net

deferred tax assets of approximately $0.6 billion. If Kodak were to determine that it would not be able to realize a portion of its net deferred tax

assets in the future, for which there is currently no valuation allowance, an adjustment to the net deferred tax assets would be charged to earnings

in the period such determination was made. Conversely, if Kodak were to make a determination that it is more likely than not that deferred tax

assets, for which there is currently a valuation allowance, would be realized, the related valuation allowance would be reduced and a benefit to

earnings would be recorded. Kodak considers both positive and negative evidence, in determining whether a valuation allowance is needed by

territory, including, but not limited to, whether particular entities are in three year cumulative income positions. During 2012, Kodak determined

that it was more likely than not that a portion of the deferred tax assets outside the U.S. would not be realized due to reduced manufacturing

volumes negatively impacting profitability in a location outside the U.S. and accordingly, recorded a provision of $30 million associated with the

establishment of a valuation allowance on those deferred tax assets.

In general, the amount of tax expense or benefit from continuing operations is determined without regard to the tax effects of other categories of

income or loss, such as Other comprehensive (loss) income. However, an exception to this rule applies when there is a loss from continuing

operations and income from items outside of continuing operations that must be considered. This exception requires that income from

discontinued operations, extraordinary items, and items charged or credited directly to other comprehensive income be considered in determining

the amount of tax benefit that results from a loss in continuing operations. This exception affects the allocation of the tax provision amongst

categories of income.

During 2011, Kodak concluded that the undistributed earnings of its foreign subsidiaries would no longer be considered permanently

reinvested. After assessing the assets of the subsidiaries relative to specific opportunities for reinvestment, as well

28