Kodak 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

January 1, 2013. The adoption of this guidance requires changes in presentation only and will have no impact on Kodak’s Consolidated

Financial Statements.

In July 2012, the FASB issued ASU No. 2012-02, “Intangibles-Goodwill and Other (ASC Topic 350) – Testing Indefinite-Lived Intangible

Assets for Impairment.” ASU No. 2012-02 amends the impairment test for indefinite-lived intangible assets by allowing companies to first

assess the qualitative factors to determine if it is more likely than not that an indefinite-lived intangible asset might be impaired as a basis for

determining whether it is necessary to perform the quantitative impairment test. The changes to the ASC as a result of this update are effective

prospectively for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012 (January 1, 2013 for

Kodak). Kodak does not expect that the adoption of this guidance will have a material impact on its Consolidated Financial Statements.

In December 2011, the FASB issued ASU No. 2011-10, “Derecognition of in Substance Real Estate – a Scope Clarification,” which amends

ASC Topic 360, “Property, Plant and Equipment.” ASU No. 2011-10 states that when an investor ceases to have a controlling financial interest

in an entity that is in-substance real estate as a result of a default on the entity’s nonrecourse debt, the investor should apply the guidance under

ASC Subtopic 360-20, Property, Plant and Equipment – Real Estate Sales to determine whether to derecognize the entity’s assets (including real

estate) and liabilities (including the nonrecourse debt). The changes to the ASC as a result of this update are effective prospectively for

deconsolidation events occurring during fiscal years, and interim periods within those years, beginning on or after June 15, 2012 (January 1,

2013 for Kodak). Adoption of this guidance will not impact Kodak’s Consolidated Financial Statements.

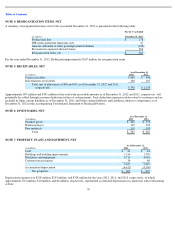

NOTE 3: LIABILITIES SUBJECT TO COMPROMISE

The following table reflects pre-petition liabilities that are subject to compromise.

The Bankruptcy Filing constituted an event of default with respect to certain of the Company’s debt instruments. Refer to Note 11, “Short-Term

Borrowings and Long-Term Debt” for additional information. Settlements relate to allowed claims under agreements reached with various

creditors, including $650 million related to the settlement agreement reached with the Retiree Committee. Refer to Note 1, “Bankruptcy

Proceedings” for additional information. Other liabilities subject to compromise include accrued liabilities for customer programs, deferred

compensation, environmental, taxes, and contract and lease rejections.

The amount of liabilities subject to compromise represents the Debtors’ estimate, where an estimate is determinable, of known or potential pre-

petition claims to be addressed in connection with the bankruptcy proceedings. Such liabilities are reported at the Debtors’ current estimate,

where an estimate is determinable, of the allowed claim amount, even though they may settle for lesser amounts. These claims remain subject to

future adjustments, which may result from: negotiations; actions of the Bankruptcy Court; disputed claims; rejection of contracts and unexpired

leases; the determination as to the value of any collateral securing claims; proofs of claims; or other events. Refer to Note 1, “Bankruptcy

Proceedings” for additional information.

69

(in millions)

As of

December 31,

2012

Accounts payable

$

283

Debt

683

Pension and other postemployment obligations

785

Settlements

710

Other liabilities subject to compromise

255

Liabilities subject to compromise

$

2,716