Kodak 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

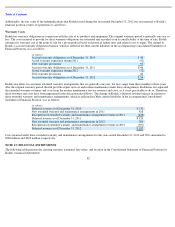

the close of business on the business day immediately preceding the maturity date for the notes. Upon conversion, the Company shall deliver or

pay, at its election, solely shares of its common stock or solely cash. Holders of the 2017 Convertible Notes may require the Company to

purchase all or a portion of the convertible notes at a price equal to 100% of the principal amount of the convertible notes to be purchased, plus

accrued and unpaid interest, in cash, upon occurrence of certain fundamental changes involving the Company including, but not limited to, a

change in ownership, consolidation or merger, plan of dissolution, or common stock delisting from a U.S. national securities exchange.

The 2017 Convertible Notes are the Company’s senior unsecured obligations and rank: (i) senior in right of payment to the Company’s existing

and future indebtedness that is expressly subordinated in right of payment to the 2017 Convertible Notes; (ii) equal in right of payment to the

Company’

s existing and future unsecured indebtedness that is not so subordinated; (iii) effectively subordinated in right of payment to any of the

Company’s secured indebtedness to the extent of the value of the assets securing such indebtedness; and (iv) structurally subordinated to all

existing and future indebtedness and obligations incurred by the Company’s subsidiaries including guarantees of the Company’s obligations by

such subsidiaries. U.S. Bank, National Association replaced and succeeded Bank of New York Mellon as Trustee on January 24, 2012.

The Bankruptcy Filing constituted an event of default under the 2017 Convertible Notes. The creditors are, however, stayed from taking any

action as a result of the default under Section 362 of the Bankruptcy Code.

SENIOR NOTES DUE 2013

On October 10, 2003, the Company completed the offering and sale of $500 million aggregate principal amount of Senior Notes due 2013 (the

“2013 Notes”), which was made pursuant to the Company’s shelf registration statement on Form S-3 effective September 19, 2003. Interest on

the 2013 Notes will accrue at the rate of 7.25% per annum and is payable semiannually. The 2013 Notes are not redeemable at the Company’s

option or repayable at the option of any holder prior to maturity. The 2013 Notes are unsecured and unsubordinated obligations, and rank equally

with all of the Company’s other unsecured and unsubordinated indebtedness.

On March 10, 2010, the Company accepted for purchase $200 million aggregate principal amount of the 2013 Notes pursuant to the terms of a

tender offer that commenced on February 3, 2010. The tender offer was funded with proceeds from the issuance of the 2018 Senior Secured

Notes.

On March 15, 2011, the Company repurchased $50 million aggregate principal amount of the 2013 Notes at par using proceeds from the

issuance of the 2019 Senior Secured Notes. As of December 31, 2012, $250 million of the 2013 Notes remain outstanding. U.S. Bank, National

Association replaced and succeeded Bank of New York Mellon as Trustee on January 24, 2012.

The Bankruptcy Filing constituted an event of default under the 2013 Notes. The creditors are, however, stayed from taking any action as a result

of the default under Section 362 of the Bankruptcy Code.

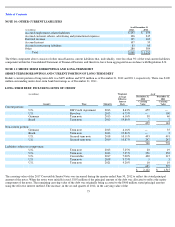

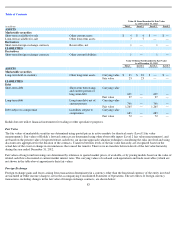

NOTE 12: OTHER LONG-TERM LIABILITIES

The Other component above consists of other miscellaneous long-term liabilities that, individually, were less than 5% of the total liabilities

component in the accompanying Consolidated Statement of Financial Position, and therefore, have been aggregated in accordance with

Regulation S-X.

NOTE 13: COMMITMENTS AND CONTINGENCIES

78

As of December 31,

(in millions)

2012

2011

Non

-current tax-related liabilities

$

36

$

57

Environmental liabilities

72

96

Asset retirement obligations

70

66

Other

194

243

Total

$

372

$

462