Kodak 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202

|

|

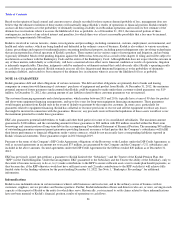

Table of Contents

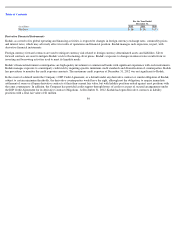

Derivative Financial Instruments

Kodak, as a result of its global operating and financing activities, is exposed to changes in foreign currency exchange rates, commodity prices,

and interest rates, which may adversely affect its results of operations and financial position. Kodak manages such exposures, in part, with

derivative financial instruments.

Foreign currency forward contracts are used to mitigate currency risk related to foreign currency denominated assets and liabilities. Silver

forward contracts are used to mitigate Kodak’s risk to fluctuating silver prices. Kodak’s exposure to changes in interest rates results from its

investing and borrowing activities used to meet its liquidity needs.

Kodak’s financial instrument counterparties are high-quality investment or commercial banks with significant experience with such instruments.

Kodak manages exposure to counterparty credit risk by requiring specific minimum credit standards and diversification of counterparties. Kodak

has procedures to monitor the credit exposure amounts. The maximum credit exposure at December 31, 2012 was not significant to Kodak.

In the event of a default under the Company’s DIP Credit Agreement, or a default under any derivative contract or similar obligation of Kodak,

subject to certain minimum thresholds, the derivative counterparties would have the right, although not the obligation, to require immediate

settlement of some or all open derivative contracts at their then-current fair value, but with liability positions netted against asset positions with

the same counterparty. In addition, the Company has provided credit support through letters of credit or as part of secured arrangements under

the DIP Credit Agreement for its derivative contract obligations. At December 31, 2012, Kodak had open derivative contracts in liability

positions with a total fair value of $1 million.

84

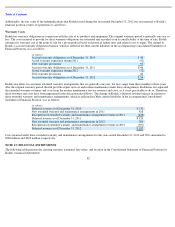

For the Year Ended

December 31,

(in millions)

2012

2011

2010

Net loss

$

(16

)

$

(14

)

$

(5

)