Kodak 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

acquirers of Kodak’

s digital imaging patent portfolio. In accordance with the DIP Credit Agreement, approximately $419 million of the proceeds

was used to prepay the term loan under the DIP Credit Agreement.

On February 28, 2013, the Company and members of the Steering Committee of the Second Lien Noteholders (the “Commitment Parties”)

agreed to structure and arrange a Junior DIP Facility with an aggregate principal amount of up to $848 million of term loans. The term loans

would consist of first lien term loans in the aggregate principal amount of $455 million (the “New Money Loans”) and junior lien term loans in

the aggregate principal amount of up to $375 million consisting of a dollar-for-dollar “roll-up” (such loans, the “Rolled-Up Loans”)

for a portion

of the amounts outstanding under the Company’s 2019 Senior Secured Notes issued March 15, 2011 and 2018 Senior Secured Notes issued

March 5, 2010 (the “Second Lien Notes”). The Bankruptcy Filing created an event of default under the Second Lien Notes. The Junior DIP

Facility will allow for payment of certain fees in cash or additional New Money Loans. The Junior DIP Facility would also contain provisions

allowing for a conversion of up to $654 million of the Junior DIP Facility loans upon emergence from chapter 11 into permanent exit financing

with a five year term, provided that Kodak meets certain conditions and milestones, including Bankruptcy Court approval of a reorganization

plan by September 15, 2013 with an effective date of no later than September 30, 2013; repayment of $200 million of principal amount of New

Money Loans; the resolution of all obligations owing in respect of the KPP obligations on terms reasonably satisfactory to the “Required Lead

Lenders” (as defined in the agreement with the Commitment Parties); there shall have been an additional prepayment of loans in an amount

equal to 75% of U.S. Liquidity (as defined in the agreement with the Commitment Parties) above $200 million; and receiving at least $600

million in cash proceeds through the disposition of certain specified assets that are not part of the Commercial Imaging business, including any

combination of the Document Imaging and Personalized Imaging businesses and trademarks and related rights provided that, consent of the

Required Lead Lenders would be necessary to exclude the assets of the Document Imaging and/or Personalized Imaging businesses from the

disposition. Closing of the Junior DIP Facility is subject to certain conditions, including approval by the Bankruptcy Court of the Junior DIP

Facility, repayment in full of the term loans under the DIP Credit Agreement and consent of the ABL lenders under the existing DIP Credit

Agreement. On March 1, 2013, the Debtors filed a motion with the Bankruptcy Court seeking approval of the Junior DIP Facility. The

Bankruptcy Court approved the Debtors’ motion on March 8, 2013. The agreement with the Commitment Parties expires on April 5, 2013.

On February 6, 2013, the Company received consents for an amendment from the lenders under its DIP Credit Agreement to extend the covenant

requirement to file a plan of reorganization and disclosure statement with the bankruptcy court from February 15, 2013 to April 30, 2013. The

Company also sought consent for an additional amendment to permit the incurrence of the Junior DIP Facility and to (i) extend the maturity date

of the DIP Credit Agreement facility from July 20, 2013 to September 30, 2013, to match the maturity of the Junior DIP Facility, (ii) eliminate

the Canadian revolving facility, which is not being used by Kodak, and reduce the aggregate amount of the U.S. revolving credit commitments

from $225 million to $200 million, (iii) remove machinery and equipment from the borrowing base of the revolving facility and (iv) revise the

existing financial covenants and modify other covenants to match the terms proposed for the Junior DIP Facility. This additional amendment did

not become effective because a condition to effectiveness was closing the Junior DIP Facility on or before February 28, 2013. The Company has

engaged the DIP Credit Agreement agent to solicit the ABL DIP Credit Agreement lenders to re-consent for this amendment with a new

expiration date of April 5, 2013.

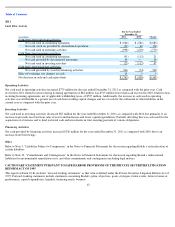

Cash and cash equivalents are held in various locations throughout the world. At December 31, 2012 and December 31, 2011, approximately

$324 million and $170 million, respectively, of cash and cash equivalents were held within the U.S. and approximately $811 million and $691

million, respectively, of cash and cash equivalents were held outside the U.S. During 2012, approximately $121 million of cash was repatriated,

or loaned, from foreign subsidiaries to the U.S., net of loans and repayments of loans to foreign subsidiaries. Total cash and cash equivalents at

December 31, 2012 and December 31, 2011 were $1,135 million and $861 million, respectively. Kodak utilizes a variety of tax planning and

financing strategies in an effort to ensure that cash is available in locations where it is needed. Cash balances held outside of the U.S. are

generally required to support local country operations, may have high tax costs, or other limitations that delay the ability to repatriate, and

therefore may not be readily available for transfer to other jurisdictions. Additionally, in China, where approximately $235 million of cash and

cash equivalents were held as of December 31, 2012, there are limitations related to net asset balances that impact the ability to make cash

available to other jurisdictions in the world. Under the terms of the DIP Credit Agreement, the Debtors are permitted to invest up to $100 million

at any time in subsidiaries that are not party to the loan agreement.

Kodak incurred $99 million, $29 million and $28 million of expenses for special termination benefits paid out of its U.S. defined benefit pension

plans in 2012, 2011 and 2010, respectively. The plan provision providing for the special termination benefits expired at the end of 2012.

Kodak’s business may not generate cash flow in an amount sufficient to enable it to pay the principal of, or interest on Kodak’s indebtedness, or

to fund Kodak’s other liquidity needs, including working capital, capital expenditures, product development efforts, strategic acquisitions,

investments and alliances, restructuring actions, costs related to the cases and other general corporate requirements. If Kodak cannot fund its

liquidity needs, it will have to take actions such as reducing or delaying capital expenditures, product development efforts, strategic acquisitions,

and investments and alliances; selling additional assets; restructuring or refinancing its debt; or seeking additional equity capital. These actions

may be restricted as a result of the Debtors’ chapter 11 proceedings, the DIP Credit Agreement, and, if completed, the Junior DIP Facility. Such

actions could increase Kodak’s debt, negatively impact customer confidence in Kodak’s ability to provide products and services, reduce Kodak’

s

ability to raise additional capital, delay sustained profitability, and adversely affect the Debtors’

ability to emerge from bankruptcy. There can be

no assurance that any of these remedies could, if necessary, be effected on commercially reasonable terms, or at all, or that they would permit

Kodak to meet its scheduled debt service obligations. In addition, if Kodak incurs additional debt, the risks associated with its substantial

leverage, including the risk that it will be unable to service Kodak’s debt or generate enough cash flow to fund its liquidity needs, could

intensify.

Further, the consummation of the Junior DIP Facility financing and borrowing of loans thereunder is subject to a number of conditions and there

is no assurance that these conditions will be satisfied or waived. These conditions include, among others, an amendment of the DIP Credit