Kodak 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

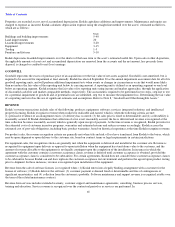

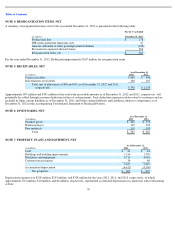

NOTE 8: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill was $278 million and $277 million as of December 31, 2012 and 2011, respectively. The carrying value of goodwill by reportable

segments is as follows:

Gross goodwill and accumulated impairment losses were $1.697 billion and $1.403 billion, respectively, as of December 31, 2010, $1.688

billion and $1.411 billion, respectively, as of December 31, 2011, and $1.689 billion and $1.411 billion, respectively, as of December 31, 2012.

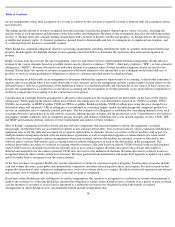

As of December 31, 2010, the net goodwill balance of $294 million, under the prior year segment reporting structure, was comprised of $201

million for the Consumer Digital Imaging Group and $93 million for the Graphic Communications Group.

As of December 31, 2011, the net goodwill balance of $277 million, under the prior year segment reporting structure, was comprised of $197

million for the Consumer Digital Imaging Group and $80 million for the Graphic Communications Group.

As a result of the change in segments that became effective as of September 30, 2012, Kodak’s reporting units changed. The Personalized and

Document Imaging segment has three reporting units: Personalized Imaging, Document Imaging and Intellectual Property. The Graphics,

Entertainment and Commercial Films segment has two reporting units: Graphics and Entertainment Imaging and Commercial Films. The Digital

Printing and Enterprise Segment has four reporting units: Digital Printing, Packaging and Functional Printing, Enterprise Services and Solutions,

and Consumer Inkjet Systems.

Prior to the September 30, 2012 change in reporting units, the only reporting units with goodwill remaining were the Consumer Digital Imaging

Group (“CDG”) and the Business Services and Solutions Group (“BSSG”). Consumer Inkjet Systems which was part of the CDG reporting unit

was transferred to the Digital Printing and Enterprise segment. Personalized Imaging and Intellectual Property, which were part of the CDG

reporting unit, are now included in the Personalized and Document Imaging Segment. Document Imaging, which was part of the BSSG

reporting unit, was transferred to the Personalized and Document Imaging segment. Workflow software which was part of BSSG was transferred

to the Graphics, Entertainment and Commercial Films segment. Enterprise Services and Solutions which was part of BSSG is included in the

Digital Printing and Enterprise Segment. Goodwill was reassigned to affected reporting units using a relative fair value allocation.

Based upon the results of Kodak’s September 30, 2012 annual impairment test analysis, no impairment of goodwill was indicated.

On February 1, 2013, Kodak sold its digital imaging patents. The cash flows related to the Intellectual Property reporting unit from patent

licensing activity will significantly change and the fair value may be materially impacted as a result of the sale. The goodwill assigned to the

Intellectual Property reporting unit as of December 31, 2012 approximated $113 million.

During 2011, due to the impact of continued pricing pressures and higher commodity costs within prepress solutions, as well as higher start-up

costs associated with the commercialization and placement of PROSPER printing systems, Kodak concluded that the carrying value of goodwill

for its Commercial Printing reporting unit exceeded the implied fair value of goodwill. Kodak recorded a pre-tax impairment charge of $8

million in 2011 that was included in Other operating (income) expenses, net in the Consolidated Statement of Operations.

During 2010, due to continuing challenging business conditions driven, in part, by rising commodity prices and a continuation of significant

declines in the FPEG business caused by digital substitution, Kodak concluded there was an indication of a possible goodwill impairment related

to the FPEG segment. Based on its analysis, Kodak concluded that there was an impairment of

71

(in millions)

Graphics,

Entertainment and

Commercial Films

Segment

Digital Printing

and Enterprise

Segment

Personalized and

Document Imaging

Segment

Consolidated

Total

Balance as of December 31, 2010

$

9

$

17

$

268

$

294

Impairment

(8

)

—

—

(

8

)

Divestiture

—

—

(

10

)

(10

)

Currency translation adjustments

—

—

1

1

Balance as of December 31, 2011:

$

1

$

17

$

259

$

277

Currency translation adjustments

—

—

1

1

Balance as of December 31, 2012:

$

1

$

17

$

260

$

278