Kodak 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

as the forecasted uses of cash for both its domestic and foreign operations, Kodak concluded that it was prudent to change its indefinite

reinvestment assertion to allow greater flexibility in its cash management.

Kodak operates within multiple taxing jurisdictions worldwide and is subject to audit in these jurisdictions. These audits can involve complex

issues, which may require an extended period of time for resolution. Management’s ongoing assessments of the more-likely-than-not outcomes

of these issues and related tax positions require judgment, and although management believes that adequate provisions have been made for such

issues, there is the possibility that the ultimate resolution of such issues could have an adverse effect on the earnings of Kodak. Conversely, if

these issues are resolved favorably in the future, the related provisions would be reduced, thus having a positive impact on earnings.

Pension and Other Postretirement Benefits

Kodak’s defined benefit pension and other postretirement benefit costs and obligations are estimated using several key assumptions. These

assumptions, which are reviewed at least annually by Kodak, include the discount rate, long-term expected rate of return on plan assets

(“EROA”), salary growth, healthcare cost trend rate and other economic and demographic factors. Actual results that differ from Kodak’s

assumptions are recorded as unrecognized gains and losses and are amortized to earnings over the estimated future service period of the active

participants in the plan or, if almost all of a plan’

s participants are inactive, the average remaining lifetime expectancy of inactive participants, to

the extent such total net unrecognized gains and losses exceed 10% of the greater of the plan’s projected benefit obligation or the calculated

value of plan assets. Significant differences in actual experience or significant changes in future assumptions would affect Kodak’s pension and

other postretirement benefit costs and obligations.

Asset and liability modeling studies are utilized by Kodak to adjust asset exposures and review a liability hedging program through the use of

forward looking correlation, risk and return estimates. Those forward looking estimates of correlation, risk and return generated from the

modeling studies are also used to estimate the EROA. The EROA is estimated utilizing a forward-looking building block model factoring in the

expected risk of each asset category, return and correlation over a 5-7 year horizon, and weighting the exposures by the current asset allocation.

Historical inputs are utilized in the forecasting model to frame the current market environment with adjustments made based on the forward

looking view. Kodak aggregates investments into major asset categories based on the underlying benchmark of the strategy. Kodak’s asset

categories include broadly diversified exposure to U.S. and non-U.S. equities, U.S. and non-U.S. government and corporate bonds, inflation-

linked bonds, commodities and absolute return strategies. Each allocation to these major asset categories is determined within the overall asset

allocation to accomplish unique objectives, including enhancing portfolio return, providing portfolio diversification, or hedging plan liabilities.

The EROA, once set, is applied to the calculated value of plan assets in the determination of the expected return component of Kodak’s pension

expense. Kodak uses a calculated value of plan assets, which recognizes changes in the fair value of assets over a four-year period, to calculate

expected return on assets. At December 31, 2012, the calculated value of the assets of Kodak’s major U.S. and Non-

U.S. defined benefit pension

plans was approximately $7.3 billion and the fair value was also approximately $7.3 billion. Asset gains and losses that are not yet reflected in

the calculated value of plan assets are not included in amortization of unrecognized gains and losses.

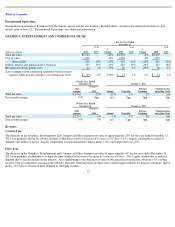

Kodak reviews its EROA assumption annually. To facilitate this review, every three years, or when market conditions change materially,

Kodak’s larger plans will undertake asset allocation or asset and liability modeling studies. The weighted average EROA for major U.S. and

non-U.S. defined benefit pension plans used to determine net pension expense was 8.52% and 7.02%, respectively, for the year ended

December 31, 2012.

Generally, Kodak bases the discount rate assumption for its significant plans on high quality corporate bond yields in the respective countries as

of the measurement date. Specifically, for its U.S. and Canadian plans, Kodak determines a discount rate using a cash flow model to incorporate

the expected timing of benefit payments and an AA-rated corporate bond yield curve. For Kodak’s U.S. plans, the Citigroup Above Median

Pension Discount Curve is used. For Kodak’s other non-U.S. plans, the discount rates are determined by comparison to published local high

quality bond yields or indices considering estimated plan duration and removing any outlying bonds, as warranted.

The salary growth assumptions are determined based on Kodak’s long-term actual experience and future and near-term outlook. The healthcare

cost trend rate assumptions are based on historical cost and payment data, the near-term outlook and an assessment of the likely long-term

trends.

29