Kodak 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

goodwill related to the FPEG segment. Kodak recorded a pre-tax impairment charge of $626 million in the fourth quarter of 2010 that was

included in Other operating expenses (income), net in the Consolidated Statement of Operations.

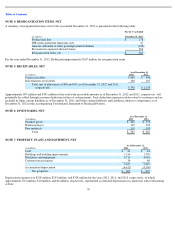

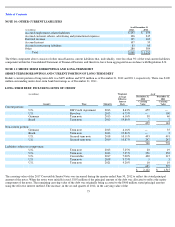

The gross carrying amount and accumulated amortization by major intangible asset category as of December 31, 2012 and 2011 were as follows:

Amortization expense related to intangible assets was $27 million, $41 million, and $60 million for the years ended December 31, 2012, 2011,

and 2010, respectively.

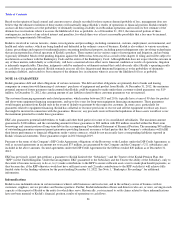

Estimated future amortization expense related to purchased intangible assets as of December 31, 2012 was as follows (in millions):

NOTE 9: OTHER LONG-TERM ASSETS

The Other component above consists of other miscellaneous long-term assets that, individually, were less than 5% of Kodak’s total assets in the

accompanying Consolidated Statement of Financial Position, and therefore, have been aggregated in accordance with Regulation S-X.

72

As of December 31, 2012

(in millions)

Gross Carrying

Amount

Accumulated

Amortization

Net

Weighted

-

Average

Amortization Period

Technology-based

$

51

$

47

$

4

8 years

Customer

-

related

222

172

50

10 years

Other

16

9

7

18 years

Total

$

289

$

228

$

61

10 years

As of December 31, 2011

(in millions)

Gross Carrying

Amount

Accumulated

Amortization

Net

Weighted

-

Average

Amortization Period

Technology-based

$

146

$

133

$

13

7 years

Customer

-

related

223

157

66

10 years

Other

16

8

8

18 years

Total

$

385

$

298

$

87

9 years

2013

$

14

2014

11

2015

10

2016

10

2017

9

2018+

7

Total

$

61

As of December 31,

(in millions)

2012

2011

Deferred income taxes, net of valuation allowance

$

470

$

429

Intangible assets

61

87

Other

206

263

Total

$

737

$

779