Kodak 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

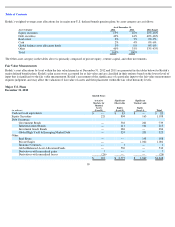

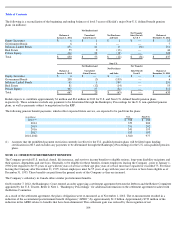

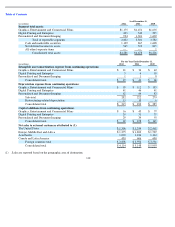

Further information relating to stock options is as follows:

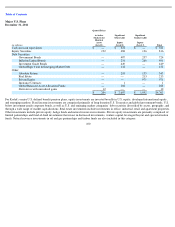

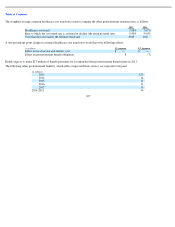

The following table summarizes information about stock options as of December 31, 2012:

(Number of options in thousands)

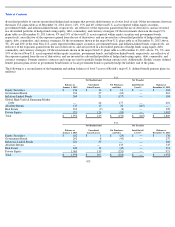

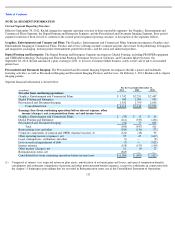

At December 31, 2012, the weighted-average remaining contractual term of all options outstanding and exercisable was 2.70 years and 2.38

years respectively. There was no intrinsic value of options outstanding and exercisable due to the fact that the market price of the Company

’s

common stock as of December 31, 2012 was below the weighted-average exercise price of options. There were no option exercises during 2010,

2011 or 2012.

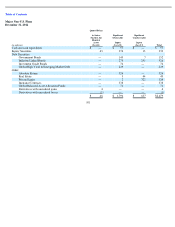

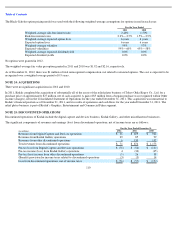

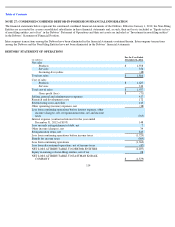

The fair value of each option award is estimated on the date of grant using the Black-Scholes option valuation model that uses the assumptions

noted in the following table. Expected volatilities are based on historical volatility of the Company’s stock, management’s estimate of implied

volatility of the Company’s stock, and other factors. The expected term of options granted is derived from the vesting period of the award, as

well as historical exercise behavior, and represents the period of time that options granted are expected to be outstanding. The risk-free rate is

calculated using the U.S. Treasury yield curve, and is based on the expected term of the option. Kodak uses historical data to estimate forfeitures.

109

(Amounts in thousands, except per share amounts)

Shares

Under

Option

Range of Price

Per Share

Weighted

-

Average

Exercise

Price

Per Share

Outstanding on December 31, 2009

23,520

$

2.64

-

$65.91

$

28.55

Granted

300

$

3.96

-

$5.96

$

4.17

Exercised

—

N/A

N/A

Terminated, Expired, Surrendered

5,790

$

7.41

-

$

65.91

$

37.68

Outstanding on December 31, 2010

18,030

$

2.64

-

$

48.34

$

25.22

Granted

2,179

$

2.82

-

$

5.22

$

3.41

Exercised

—

N/A

N/A

Terminated, Expired, Surrendered

6,599

$

3.40

-

$

65.91

$

31.07

Outstanding on December 31, 2011

13,610

$

2.64

-

$

38.04

$

18.89

Granted

—

N/A

N/A

Exercised

—

N/A

N/A

Terminated, Expired, Surrendered

5,670

$

3.40

-

$

38.04

$

27.97

Outstanding on December 31, 2012

7,940

$

2.64

-

$36.66

$

12.40

Exercisable on December 31, 2010

16,036

$

2.64

-

$48.34

$

27.64

Exercisable on December 31, 2011

10,568

$

2.64

-

$38.04

$

23.25

Exercisable on December 31, 2012

6,456

$

2.64

-

$36.66

$

14.38

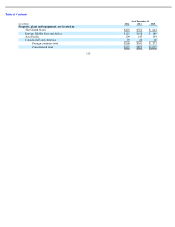

Options Outstanding

Options Exercisable

Range of Exercise

Weighted

-

Average

Prices

Remaining

At

Less

Contractual

Weighted

-

Average

Weighted

-

Average

Least

Than

Options

Life (Years)

Exercise Price

Options

Exercise Price

$2

-

$10

5,145

3.56

$

5.34

3,661

$

5.96

$10

-

$30

2,222

1.33

$

23.97

2,222

$

23.97

$30

-

$40

573

0.28

$

31.00

573

$

31.00

7,940

6,456