Kodak 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

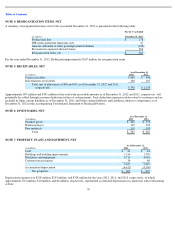

If Kodak had reported earnings from continuing operations for the years ended December 31, 2012, 2011, and 2010, the following potential

shares of Kodak’s common stock would have been dilutive in the computation of diluted earnings per share:

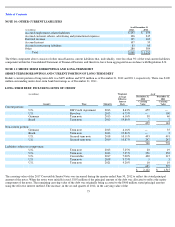

The computation of diluted earnings per share for the years ended December 31, 2012, 2011, and 2010 also excluded the assumed conversion of

outstanding employee stock options and detachable warrants to purchase common shares, because the effects would be anti-dilutive. The

following table sets forth the total amount of outstanding employee stock options and detachable warrants to purchase common shares as of

December 31 for each reporting period:

Diluted earnings per share calculations could also reflect shares related to the assumed conversion of approximately $400 million of convertible

senior notes due 2017, if dilutive. Kodak’s diluted (loss) earnings per share excludes the effect of these convertible securities, as they were anti-

dilutive for all periods presented. Refer to Note 11, “Short-Term Borrowings and Long-Term Debt.”

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

In September 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-08, “Intangibles-

Goodwill and Other (Accounting Standards Codification (ASC) Topic 350) – Testing Goodwill for Impairment.” ASU No. 2011-08 amends the

impairment test for goodwill by allowing companies to first assess qualitative factors to determine if it is more likely than not that goodwill

might be impaired and whether it is necessary to perform the current two-step goodwill impairment test. The changes to the ASC as a result of

this update were effective prospectively for interim and annual periods beginning after December 15, 2011 (January 1, 2012 for Kodak). The

adoption of this guidance did not impact Kodak’s Consolidated Financial Statements.

In June 2011, the FASB issued ASU No. 2011-05, “Comprehensive Income (ASC Topic 220)—Presentation of Comprehensive Income.” ASU

No. 2011

-05 eliminates the option to present the components of other comprehensive income as part of the statement of equity and requires an

entity to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in

a single continuous statement of comprehensive income or in two separate but consecutive statements. Subsequently, the FASB issued ASU

No. 2011

-12, “Comprehensive Income (ASC Topic 220) – Deferral of the Effective Date for Amendments to the Presentation of

Reclassifications of Items Out of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05.” ASU 2011-12

deferred the provision within ASU 2011-05 requiring entities to present reclassification adjustments out of accumulated other comprehensive

income by component in both the income statement and the statement in which other comprehensive income is presented. ASU 2011-

12 does not

change the other provisions instituted within ASU 2011-05. The amendments of both ASUs were effective retrospectively for fiscal years, and

interim periods within those years, beginning after December 15, 2011 (January 1, 2012 for Kodak). The adoption of this guidance required

changes in presentation only and did not have an impact on Kodak’s Consolidated Financial Statements.

In May 2011, the FASB issued ASU No. 2011-04, “Fair Value Measurement (ASC Topic 820)—Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.” ASU No. 2011-04 amends current fair value measurement and

disclosure guidance to include increased transparency around valuation inputs and investment categorization. The changes to the ASC as a result

of this update were effective prospectively for interim and annual periods beginning after December 15, 2011 (January 1, 2012 for Kodak). The

adoption of this guidance did not have a significant impact on Kodak’s Consolidated Financial Statements.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In February 2013, the FASB issued ASU No. 2013-02, “Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive

Income.” ASU No. 2013-02 requires presentation of reclassification adjustments from each component of accumulated other comprehensive

income either in a single note or parenthetically on the face of the financial statements, for those amounts required to be reclassified into Net

income in their entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety in the same reporting

period, cross-reference to other disclosures is required. This update is effective for Kodak beginning

68

For the Year Ended December 31,

(in millions of shares)

2012

2011

2010

Unvested share-based awards

0.0

0.4

2.7

For the Year Ended December 31,

(in millions of shares)

2012

2011

2010

Employee stock options

7.9

13.6

18.0

Detachable warrants to purchase common shares

40.0

40.0

40.0

Total

47.9

53.6

58.0