Kodak 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

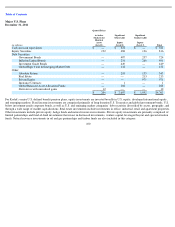

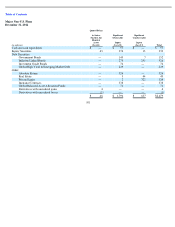

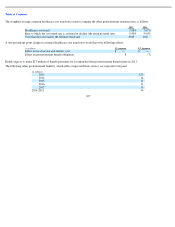

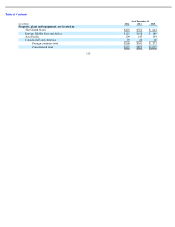

The Black-Scholes option pricing model was used with the following weighted-average assumptions for options issued in each year:

No options were granted in 2012.

The weighted-average fair value per option granted in 2011 and 2010 was $1.92 and $2.16, respectively.

As of December 31, 2012, there was $1 million of total unrecognized compensation cost related to unvested options. The cost is expected to be

recognized over a weighted-average period of 0.9 years.

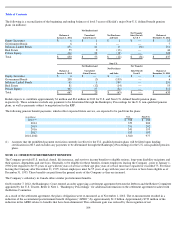

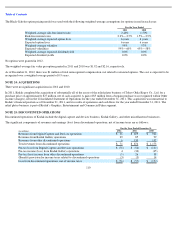

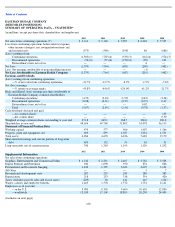

NOTE 24: ACQUISITIONS

There were no significant acquisitions in 2012 and 2010.

In 2011, Kodak completed the acquisition of substantially all of the assets of the relief plates business of Tokyo Ohka Kogyo Co., Ltd. for a

purchase price of approximately $27 million, net of cash acquired. A gain of $5 million from a bargain purchase was recognized within Other

income (charges), net in the Consolidated Statement of Operations for the year ended December 31, 2011. This acquisition was immaterial to

Kodak’s financial position as of December 31, 2011, and its results of operations and cash flows for the year ended December 31, 2011. The

relief plates business is part of Kodak’s Graphics, Entertainment and Commercial Films segment.

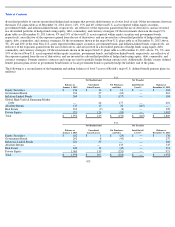

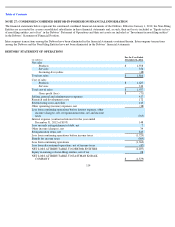

NOTE 25: DISCONTINUED OPERATIONS

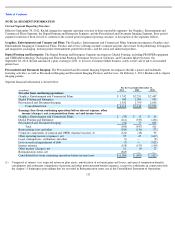

Discontinued operations of Kodak include the digital capture and devices business, Kodak Gallery, and other miscellaneous businesses.

The significant components of revenues and earnings (loss) from discontinued operations, net of income taxes are as follows:

110

For the Year Ended

2011

2010

Weighted

-

average risk

-

free interest rate

2.48%

1.50%

Risk

-

free interest rates

2.2%

—

2.5%

1.5%

—

2.9%

Weighted

-

average expected option lives

6 years

6 years

Expected option lives

6 years

6 years

Weighted

-

average volatility

59%

57%

Expected volatilities

59%

—

60%

45%

—

58%

Weighted

-

average expected dividend yield

0.0%

0.0%

Expected dividend yields

0.0%

0.0%

For the Year Ended December 31,

(in millions)

2012

2011

2010

Revenues from Digital Capture and Devices operations

$

36

$

659

$

942

Revenues from Kodak Gallery operations

29

85

99

Revenues from other discontinued operations

6

130

132

Total revenues from discontinued operations

$

71

$

874

$

1,173

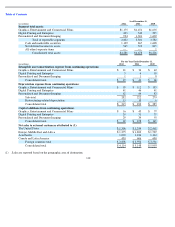

Pre

-

tax loss from Digital Capture and Devices operations

$

(78

)

$

(54

)

$

(131

)

Pre

-

tax income (loss) from Kodak Gallery operations

4

(32

)

(45

)

Pre

-

tax (loss) income from other discontinued operations

(5

)

26

38

(Benefit) provision for income taxes related to discontinued operations

(3

)

(3

)

14

Loss from discontinued operations, net of income taxes

$

(76

)

$

(57

)

$

(152

)