Kodak 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

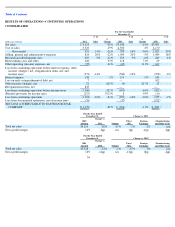

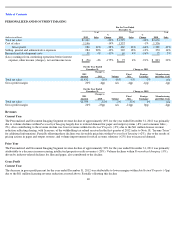

Revenues

Current Year

For the year ended December 31, 2012, net sales decreased approximately 20% compared with the same period in 2011 primarily due to volume

declines across all segments. Also included in the total decline was the $61 million license revenue reduction reflecting sharing, with licensees,

of the withholding tax refund received in the first quarter of 2012 (refer to Note 18, “Income Taxes” for additional information). See segment

discussions below for additional information.

Prior Year

For the year ended December 31, 2011, net sales decreased approximately 14% compared with the same period in 2010 due to a decline in the

P&DI segment primarily driven by lower revenue from non-recurring intellectual property licensing agreements (-13%), as discussed below.

Also contributing to the decrease in net sales were volume declines within the GECF segment (-3%). Partially offsetting these declines were

volume improvements within the DP&E segment (+2%). See segment discussion below for additional information.

Included in revenues were non-recurring intellectual property licensing agreements. These licensing agreements contributed $82 million and

$838 million to revenues in 2011 and 2010, respectively. There were no significant non-recurring intellectual property licensing agreements in

2012.

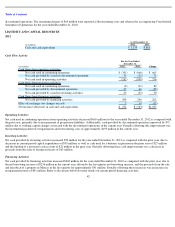

Gross Profit

Current Year

The decrease in gross profit percent from 2011 to 2012 was driven by an increase in manufacturing and other costs (-2pp) primarily due to an

increase in pension and other postemployment benefit costs in the current year. Also contributing to the decline was unfavorable price mix

within the P&DI segment (-

2pp) primarily attributable to the $61 million licensing revenue reduction as noted above. Favorable price/mix within

the DP&E segment, due to the focus on liquidity within Consumer Inkjet Systems (+3pp), partially offset the negative impacts noted. See

segment discussions below for additional details.

Prior Year

The decrease in gross profit margin from 2010 to 2011 was driven by lower margins within the P&DI segment (-10pp), largely due to the

decrease in revenue from the non-recurring intellectual property agreements as discussed below.

Included in gross profit margin were non-recurring intellectual property licensing agreements. These licensing agreements contributed $82

million and $838 million to revenues in 2011 and 2010, respectively. There were no significant non-recurring intellectual property licensing

agreements in 2012. See revenue discussion above regarding agreements related to the monetization of certain of the Company’s intellectual

property assets, including the sale of its digital imaging patents.

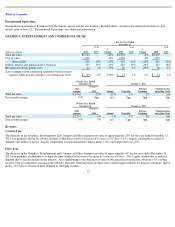

Selling, General and Administrative Expenses

The decreases in consolidated selling, general and administrative expenses (SG&A) from 2011 to 2012 and 2010 to 2011 were primarily the

result of cost reduction actions.

Research and Development Costs

The decrease in consolidated research and development costs (R&D) from 2011 to 2012 and 2010 to 2011 was primarily attributable to cost

reduction actions.

Restructuring Costs and Other

These costs, as well as the restructuring costs reported in Cost of sales, are discussed under the “RESTRUCTURING COSTS AND OTHER”

section in this MD&A.

Other Operating (Income) Expenses, Net

For details, refer to Note 16, “Other Operating (Income) Expenses, Net.”

35