Kodak 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

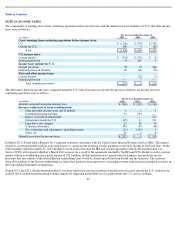

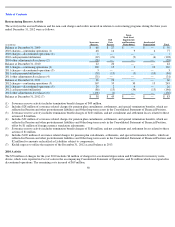

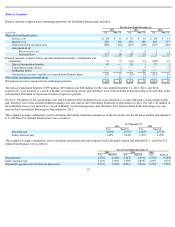

Deferred tax assets (liabilities) are reported in the following components within the Consolidated Statement of Financial Position:

As of December 31, 2012, Kodak had available domestic and foreign net operating loss carry-forwards for income tax purposes of

approximately $4,396 million, of which approximately $519 million have an indefinite carry-forward period. The remaining $3,877 million

expire between the years 2013 and 2032. As of December 31, 2012, Kodak had unused foreign tax credits and investment tax credits of $577

million and $153 million, respectively, with various expiration dates through 2027. Utilization of these net operating losses and tax credits may

be subject to limitations in the event of significant changes in stock ownership of the Company.

Kodak has been granted a tax holiday in certain jurisdictions in China. Kodak is eligible for a 50% reduction of the income tax rate as a tax

holiday incentive. The tax rate currently varies by jurisdiction, due to the tax holiday, and will be 25% in all jurisdictions within China in 2013.

During 2011, Kodak concluded that the undistributed earnings of its foreign subsidiaries would no longer be considered permanently reinvested.

After assessing the assets of the subsidiaries relative to specific opportunities for reinvestment, as well as the forecasted uses of cash for both its

domestic and foreign operations, Kodak concluded that it was prudent to change its indefinite reinvestment assertion to allow greater flexibility

in its cash management. As a result of the change in its assertion Kodak recorded a deferred tax liability (net of related foreign tax credits) of

$374 million and $396 million on the foreign subsidiaries’ undistributed earnings during the year ended December 31, 2012 and 2011,

respectively. This deferred tax liability was fully offset by a corresponding decrease in Kodak’s U.S. valuation allowance, which resulted in no

net tax provision. Kodak also recorded a provision of $6 million and $34 million for the potential foreign withholding taxes on the undistributed

earnings during the year ended December 31, 2012 and 2011, respectively.

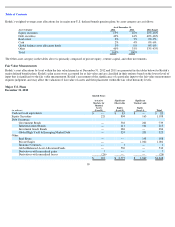

Kodak’s valuation allowance as of December 31, 2012 was $2,838 million. Of this amount, $403 million was attributable to Kodak’s net

deferred tax assets outside the U.S. of $1,001 million, and $2,435 million related to Kodak’

s net deferred tax assets in the U.S. of $2,376 million,

for which Kodak believes it is not more likely than not that the assets will be realized. The net deferred tax assets in excess of the valuation

allowance of approximately $539 million relate primarily to net operating loss carry-forwards, certain tax credits, and pension related tax

benefits for which Kodak believes it is more likely than not that the assets will be realized.

Kodak’s valuation allowance as of December 31, 2011 was $2,560 million. Of this amount, $417 million was attributable to Kodak’s net

deferred tax assets outside the U.S. of $964 million, and $2,143 million related to Kodak’s net deferred tax assets in the U.S. of $2,096 million,

for which Kodak believes it is not more likely than not that the assets will be realized. The net deferred tax assets in excess of the valuation

allowance of $500 million relate primarily to net operating loss carry-forwards, certain tax credits, and pension related tax benefits for which

Kodak believes it is more likely than not that the assets will be realized.

89

As of December 31,

(in millions)

2012

2011

Deferred income taxes (current)

$

75

$

81

Other long

-

term assets

470

429

Accrued income taxes

(5

)

(3

)

Other long

-

term liabilities

(1

)

(7

)

Net deferred tax assets

$

539

$

500