Kodak 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

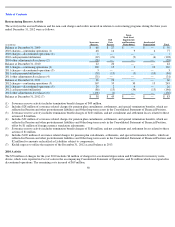

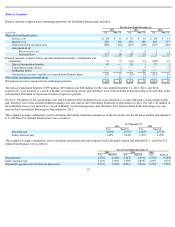

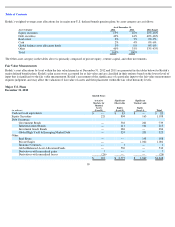

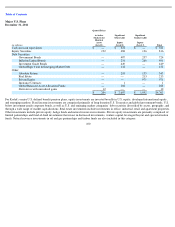

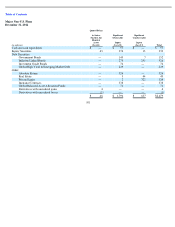

Table of Contents

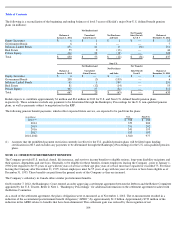

Major Non-U.S. Plans

December 31, 2011

For Kodak’s major non-U.S. defined benefit pension plans, equity investments are invested broadly in local equity, developed international and

emerging markets. Fixed income investments are comprised primarily of long duration government and corporate bonds with some emerging

market debt. Real estate investments include investments in primarily office, industrial, and retail properties. Other investments include private

equity, hedge funds, and insurance contracts. Private equity investments are comprised of limited partnerships and fund-of-fund investments that

invest in distressed investments, venture capital and leveraged buyout funds.

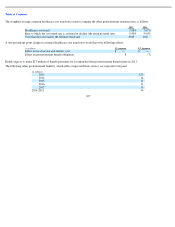

Cash and cash equivalents are valued utilizing cost approach valuation techniques. Equity securities and debt securities are valued using a market

approach based on the closing price on the last business day of the year (if the securities are traded on an active market), or based on the

proportionate share of the estimated fair value of the underlying assets (net asset value). Other investments are valued using a combination of

market, income, and cost approaches, based on the nature of the investment. Absolute return investments are primarily valued based on net asset

value derived from observable market inputs. Real estate investments are valued primarily based on independent appraisals and discounted cash

flow models, taking into consideration discount rates and local market conditions. Private equity investments are valued primarily based on

independent appraisals, discounted cash flow models, cost, and comparable market transactions, which include inputs such as discount rates and

pricing data from the most recent equity financing. Insurance contracts are primarily valued based on contract values, which approximate fair

value.

Some of the plans’ assets, primarily absolute return, real estate, and private equity, do not have readily determinable market values due to the

nature of these investments. For these investments, fund manager or general partner estimates were used where available. The estimates for the

absolute return assets are derived from observable inputs, based on the fair value of the underlying positions, which have readily available

market prices. For investments with lagged pricing, Kodak used the available net asset values, and also considered expected return, subsequent

cash flows and material events.

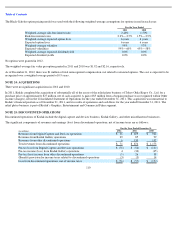

For all of Kodak’s major defined benefit pension plans, investment managers are selected that are expected to provide best-in-class asset

management for their particular asset class, and expected returns greater than those expected from existing salable assets, especially if this would

maintain the aggregate volatility desired for each plan’s portfolio. Investment managers are retained for the purpose of managing specific

investment strategies within contractual investment guidelines. Certain investment managers are authorized to invest in derivatives such as

futures, swaps, and currency forward contracts. Investments in futures and swaps are used to obtain targeted exposure to a particular asset, index

or bond duration and only require a portion of the cash to gain exposure to the notional value of the underlying investment. The remaining cash

is available to be deployed and in some cases is invested in a

102

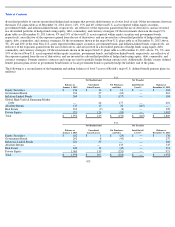

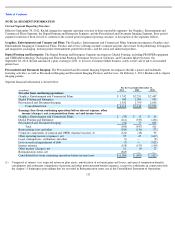

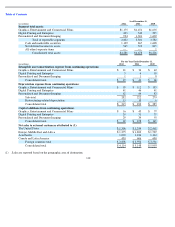

(in millions)

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Cash and cash equivalents

$

—

$

101

$

—

$

101

Equity securities

58

330

6

394

Debt securities:

Government Bonds

—

151

6

157

Inflation

-

Linked Bonds

—

356

251

607

Investment Grade Bonds

—

97

—

97

Global High Yield & Emerging Market Debt

—

223

—

223

Other:

Absolute Return

—

145

—

145

Real Estate

—

4

55

59

Private Equity

—

2

312

314

Insurance Contracts

—

339

—

339

$

58

$

1,748

$

630

$

2,436