Kodak 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

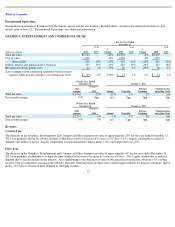

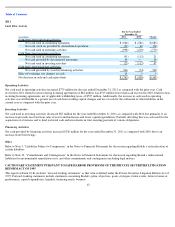

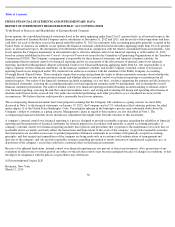

Contractual Obligations*

The impact that contractual obligations are expected to have on Kodak’s cash flow in future periods is as follows:

45

As of December 31, 2012

(in millions)

Total

2013

2014

2015

2016

2017

2018+

Long

-

term debt (1)

$

1,459

$

709

$

—

$

—

$

—

$

—

$

750

Interest payments on debt (1)

32

32

—

—

—

—

—

Operating lease obligations

157

43

31

24

18

15

26

Purchase obligations (2)

163

67

36

28

17

15

—

Total (3) (4) (5) (6)

$

1,811

$

851

$

67

$

52

$

35

$

30

$

776

* Pre-petition obligations are being administered by the Bankruptcy Court. A portion of the contractual obligations relate to non-

U.S. entities

and, therefore, are not subject to the bankruptcy proceedings.

(1) Long-term debt represents the maturity values of Kodak’s long-

term debt obligations as of December 31, 2012, excluding debt classified as

subject to compromise. Interest payments on debt represent payments related to debt that is not subject to the bankruptcy proceeding.

Interest payments to Second Lien Note holders that would be required as a result of entering into the Junior DIP Facility are not reflected

in the table above. Refer to Note 11,

“

Short

-

Term Borrowings and Long

-

Term Debt,

”

in the Notes to Financial Statements.

(2) Purchase obligations include agreements related to raw materials, supplies, production and administrative services, as well as marketing

and advertising, that are enforceable and legally binding on Kodak and that specify all significant terms, including: fixed or minimum

quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. Purchase

obligations exclude agreements that are cancelable without penalty. The terms of these agreements cover the next one to five years.

(3) Due to uncertainty regarding the completion of tax audits and possible outcomes, the remaining estimate of the timing of payments related

to uncertain tax positions and interest cannot be made. See Note 18, “Income Taxes,” in the Notes to Financial Statements for additional

information regarding Kodak

’

s uncertain tax positions.

(4) Kodak Limited, a wholly owned subsidiary of the Company (the “Subsidiary’”), has agreed with the Trustee of the KPP to make certain

contributions to the Plan. Under the terms of this agreement, the Subsidiary is obligated to pay a minimum amount of $50 million to the

KPP in each of the years 2011 through 2014, and a minimum amount of $90 million to the KPP in each of the years 2015 through 2022.

Future funding beyond 2022 would be required if the KPP is still not fully funded as determined by the funding valuation for the period

ending December 31, 2022. The payment amounts for the years 2015 through 2022 could be lower, and the payment amounts for all years

noted could be higher by up to $5 million per year, based on the exchange rate between the U.S. dollar and British pound. These minimum

amounts do not include potential contributions related to tax benefits received by the Subsidiary.

The underfunded position of the KPP of approximately $1.5 billion (calculated in accordance with U.S. GAAP) is included in Pension and

other postretirement liabilities presented in the Consolidated Statement of Financial Position as of December 31, 2012. The underfunded

obligation relates to a non-debtor entity. The Trustee has asserted an unsecured claim to the Debtors of approximately $2.8 billion under

the guarantee. The Subsidiary has also asserted an unsecured claim to the Debtors under the guarantee for an unliquidated amount. The

ultimate treatment of the Trustee’s and Subsidiary’s claims is not determinable at this time. Refer to “Off-Balance Sheet Arrangements”

discussion below and Note 1,

“

Bankruptcy Proceedings,

”

in the Notes to Financial Statements for additional details.

EKC has proposed that the Subsidiary’s 2012 and future contributions be considered part of the overall resolution of the claims of the

Trustee and Subsidiary.

(5) In addition to the pension contributions related to the KPP noted in (4) above, funding requirements for Kodak’s other major defined

benefit retirement plans and other postretirement benefit plans have not been determined, therefore, they have not been included.

(6) Because their future cash outflows are uncertain, the other long-term liabilities presented in Note 12, “Other Long-Term Liabilities,” in the

Notes to Financial Statements are excluded from this table.